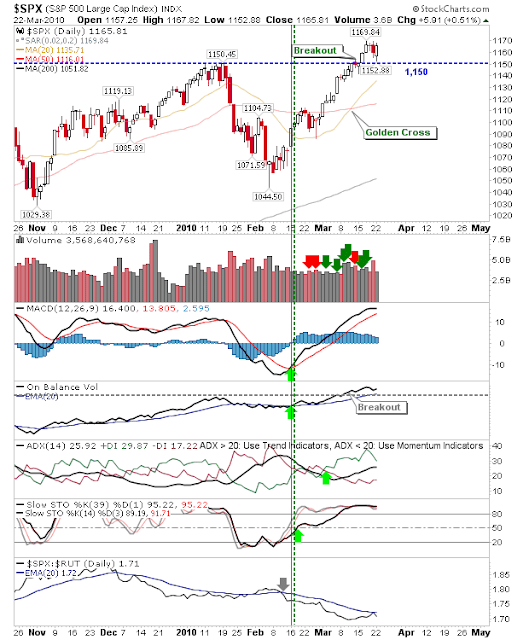

After Friday's trading, markets had posted the first significant loss on volume - enough to suggest it was the beginning of the end for the various market rallies. However, bulls proved they weren't done yet as they pulled up the boot straps from a weak open. This was no more clearly evident in the S&P which enjoyed a picture perfect defense of breakout support.

The Nasdaq closed with a surprising bullish engulfing pattern, a pattern which works best off oversold conditions, not the heated market currently experienced.

The semiconductor index posted a 2.5% gain which helped boost the Tech averages. Technicals are a little scrappy with the CCI oscillating around the '100' sell trigger line and the Directional Index running side-by-side in a net trendless fashion.

Small Caps are the tricky one. On the face of it they also enjoyed a strong day, but supporting technicals are little rockier with the MACD trigger line on the verge of a 'sell' and the CCI weakening further from an earlier 'sell' trigger. Today looked the kind of day for selling into strength - not buying.

The underlying weakness is evident market breadth indicators. Note the 'sell' trigger in the CCI of the Nasdaq Summation Index

And the underperformance relative to the Nasdaq for the Bullish Percents; CCI 'sell' trigger, MACD bearish divergence and bear cross of 3-day and 5-day EMAs. The developing weakness runs contrary to the gains posted in the Nasdaq.

Sell the Strength?

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for

Zignals.com, offers a range of stock

trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the

Zignals Dashboard or the Zignals

Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock list watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!