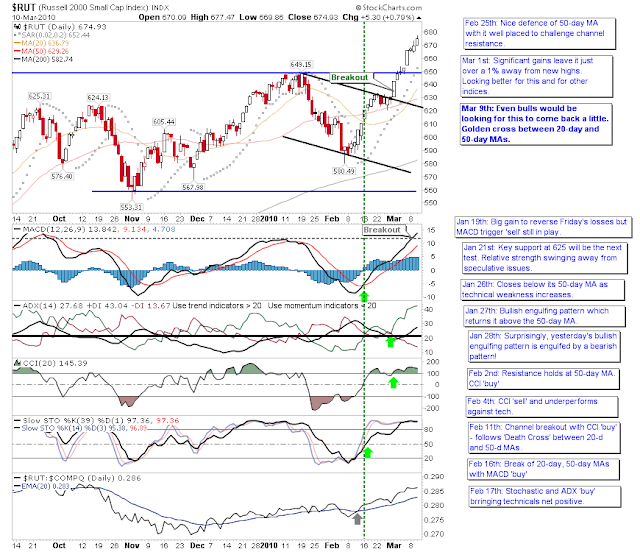

Stock Market Commentary: New Highs for Tech and Small Caps

Small Caps and Tech continued their good form. Technicals continue to support the move higher for Small Caps (Russell 2000) with new highs for the MACD and +DI line. The Russell 2000 would have to give up 25 points (or 4%) just to test breakout support at 650.

The prior underperformance of the semiconductors was undone with today's 2% gain.

This revival helped keep the rally in the Nasdaq ticking over

But Large Caps didn't quite live up to the gains of Tech and Small Caps

Last Friday's breakout gap remains the most tempting pullback zone.

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!

The prior underperformance of the semiconductors was undone with today's 2% gain.

This revival helped keep the rally in the Nasdaq ticking over

But Large Caps didn't quite live up to the gains of Tech and Small Caps

Last Friday's breakout gap remains the most tempting pullback zone.

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!