Fallondpicks.com: Weekend commentary

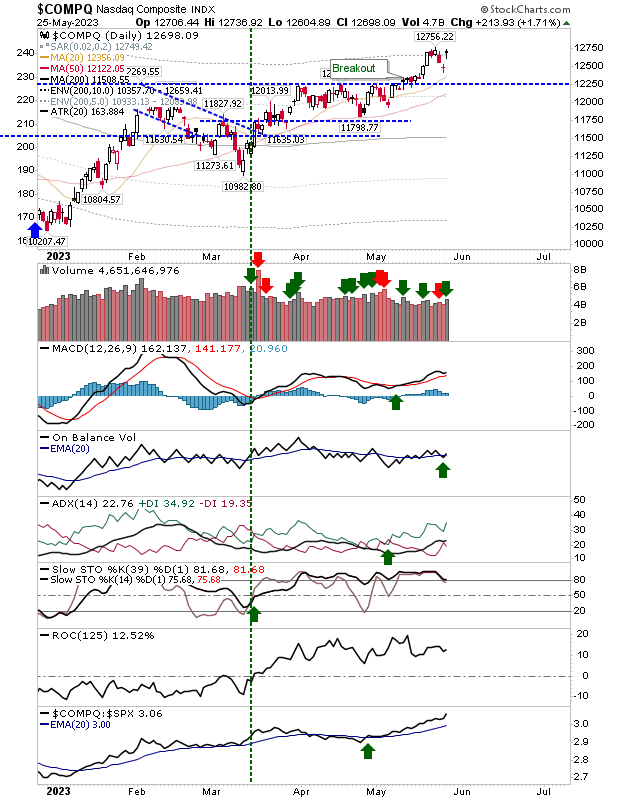

The chief change elsewhere was the new MACD 'buy' trigger in the semiconductor index, combined with a resistance break of the bearish divergence in its CCI. The index trades inside its former rising channel and is well positioned to climb higher. There should be enough momentum to see the upper part of the channel at around 510; only the 200-day MA at 477 could spoil the party.

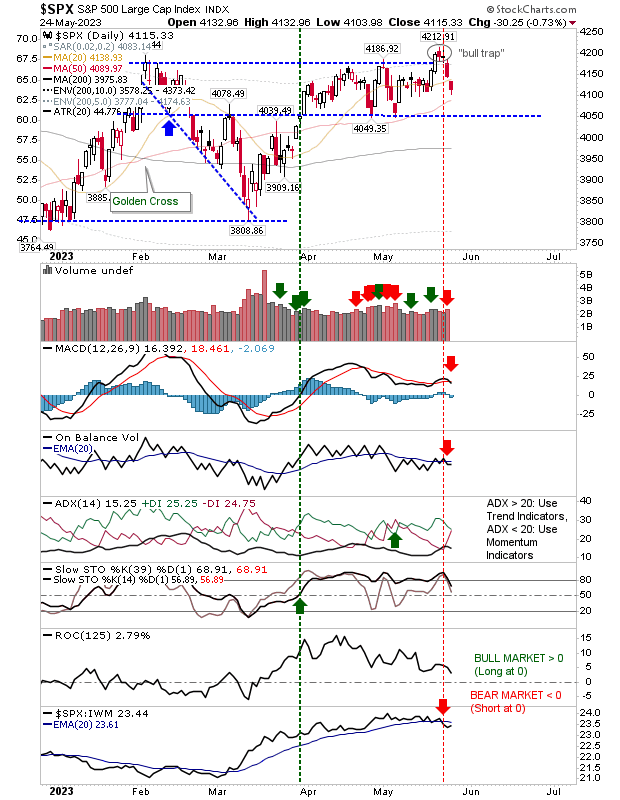

Tech market internals [$NASI, $NAA50 and $BPCOMPQ] increased their rate of ascent, but having cleared cyclical bear market reversal zones they now have plenty of room before encountering resistance levels associated with bull markets. Volatility could be the early warning system for a decline - the small bullish harami cross sets up a fear spike for Monday/Tuesday - whether that builds into something more fearful will remain to be seen.

fallond