Minor losses for Small Caps offset by small gains for Large Caps

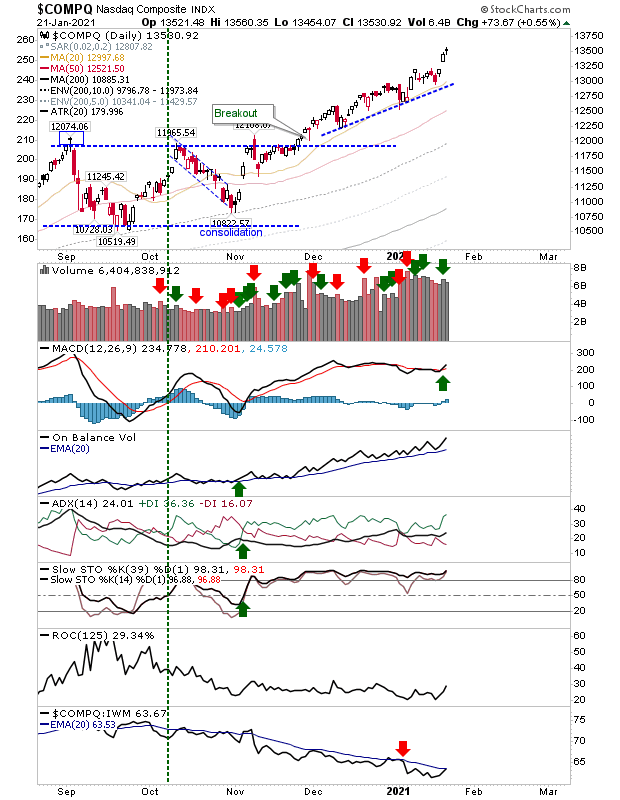

No great change for indices again. There could be an argument for a possible acceleration in the bullish trend for Large Caps and Tech Indices, but its not exactly convincing. On a positive front, technicals are in good shape across all indices.

The Nasdaq is in the process of building a relative performance advantage against Small Caps by the acceleration in the bullish trend.

The S&P just registered as a new MACD trigger 'buy', but the rate of gain is not the same as the Nasdaq.Until there is a trend break in the Russell 2000, there isn't much more to say on the indices.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.