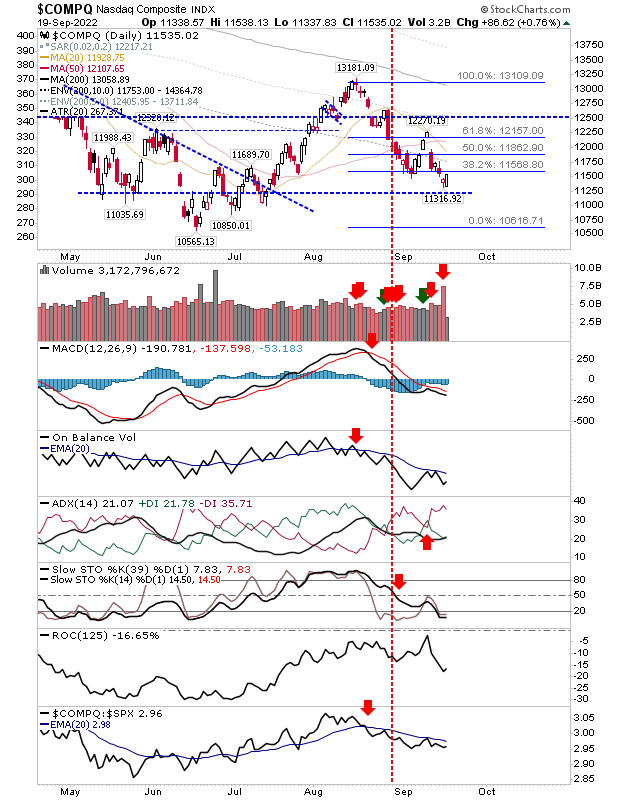

Bullish Engulfing Patterns - But Volume Light

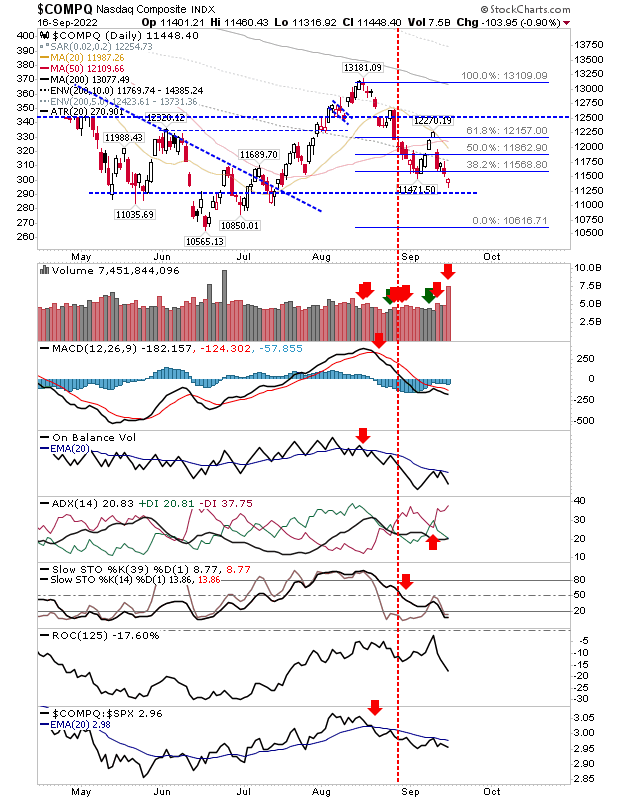

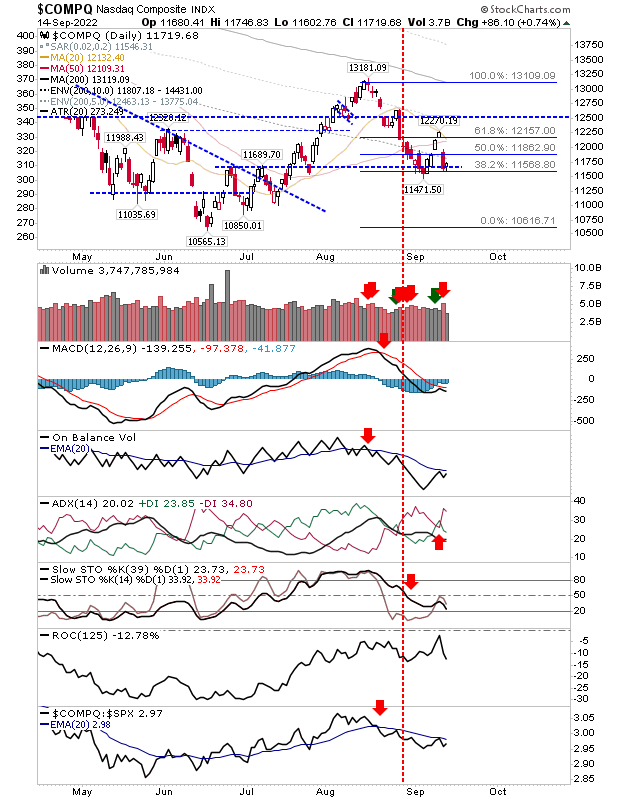

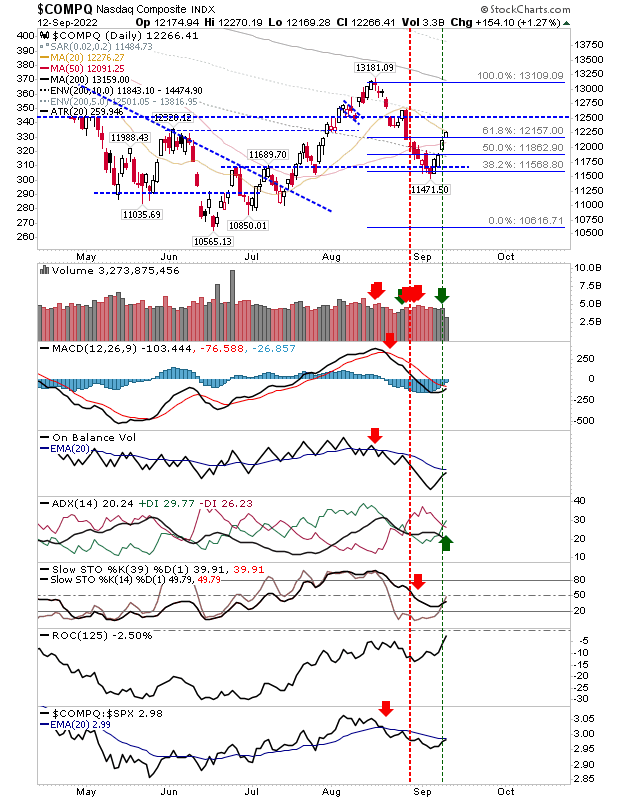

If today's buying volume was greater it would have been considered a good day; instead, it's a day with potential but still needs more from buyers to convince. On the positive side, bullish engulfing patterns like today's are reliable reversal patterns, and traders could use them as buying opportunities with a stop below the low of the pattern (exit on a close below rather than an intraday violation). How much upside to look for will be contingent on the amount of buying volume we see over the coming days, but closing the gap down in early September following the 4-day sequence of gains would be a good start as an initial target. In the case of the Nasdaq, we didn't see a whole lot of technical improvement, neither was there much in the way of relative performance gains to peer indices. So, at the moment it's a pure price play trading just above support.