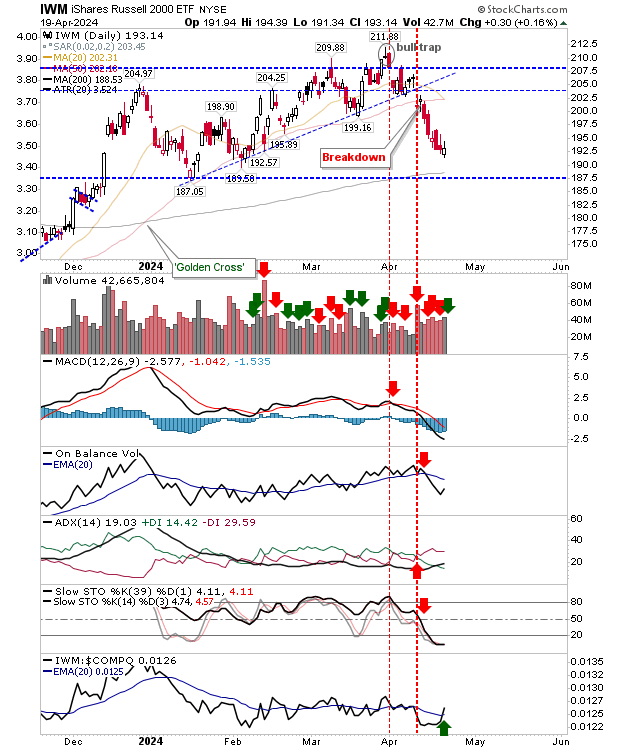

Russell 2000 ($IWM) lead indices rally

The Russell 2000 ($IWM) has been guiding towards this, but the positive reaction in the Nasdaq and S&P following Friday's gains in the Small Caps index is not enough to suggest a swing low is in place for these indices. For starters, buying volume was light and momentum remained firmly oversold. The S&P did offer an opportunity at the 50% Fib retracement, and Fib zones give the best indication the decline has found a sustainable low, or at the very least, not one prone to further panic selling.