Bears counter 'bull flags' with ruthless efficiency

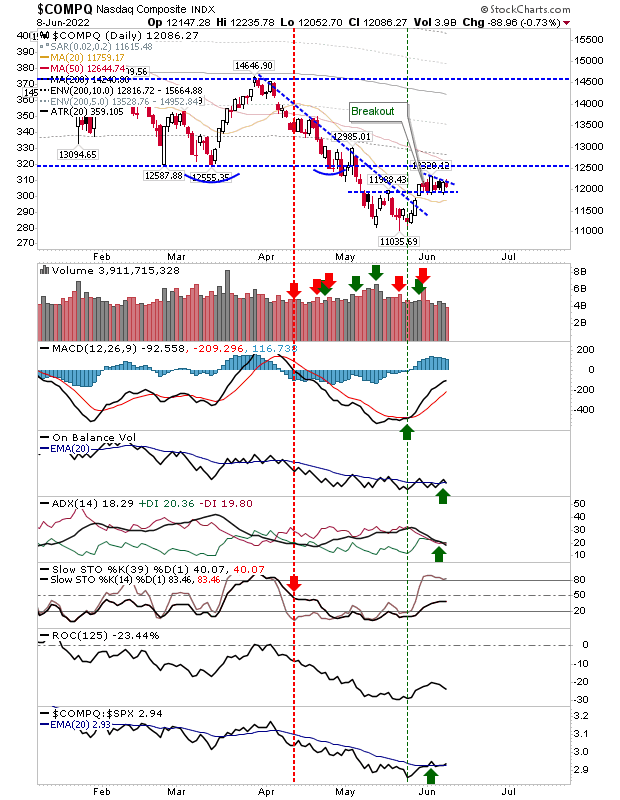

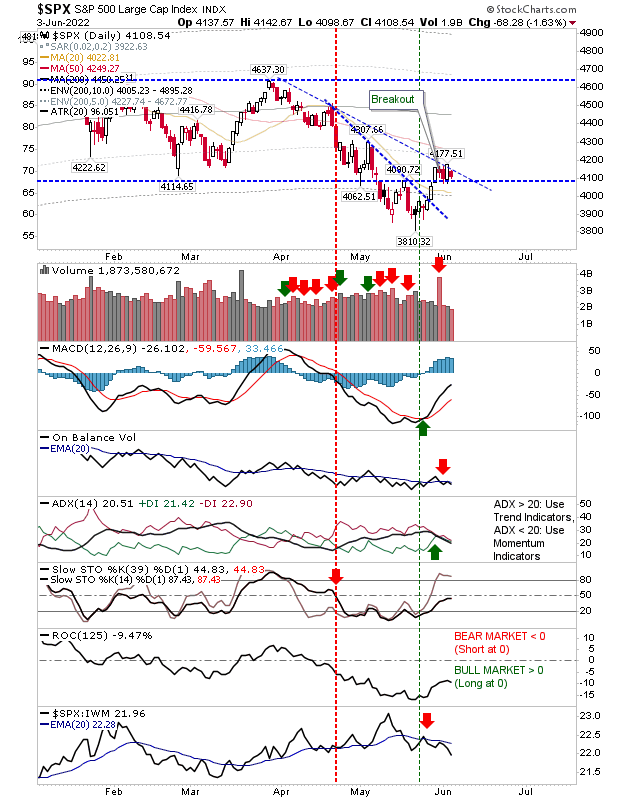

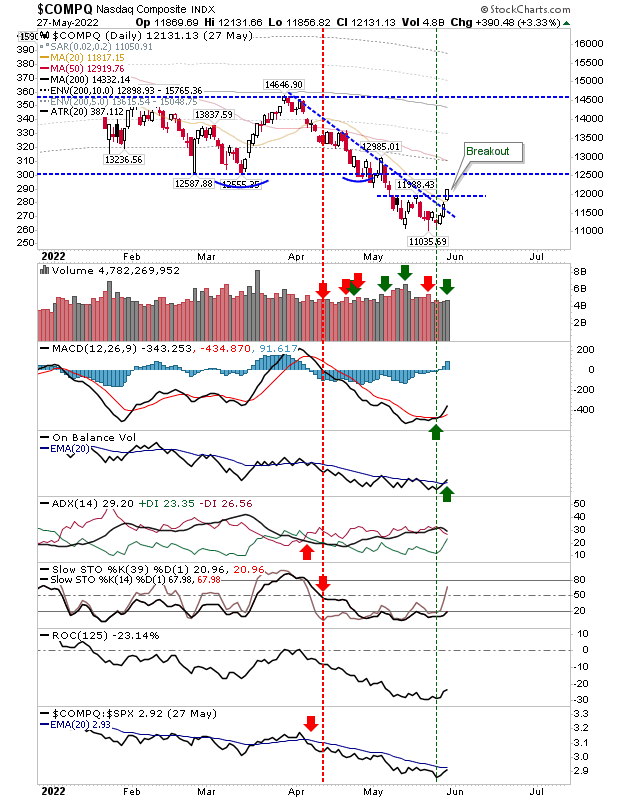

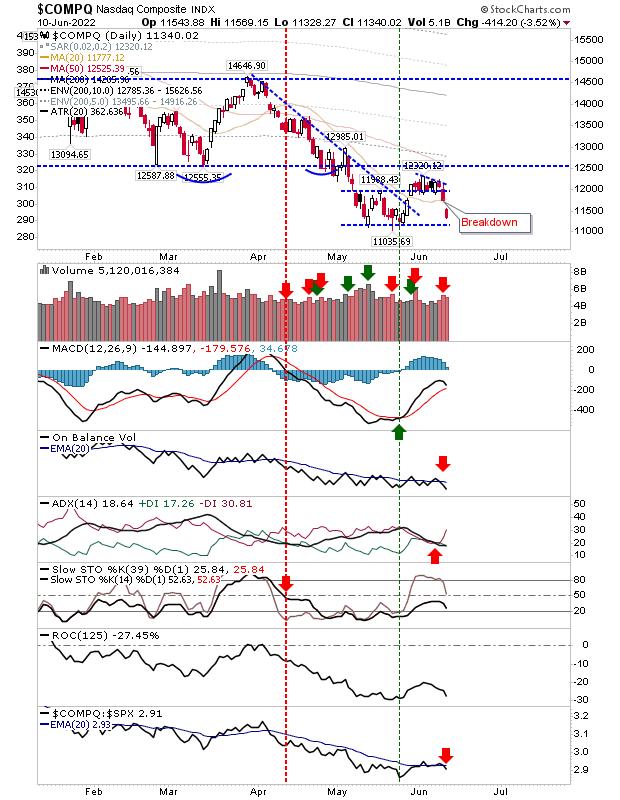

It was not to be for what had been a relatively orderly bounce from May lows. Friday's trading drove the nail into the coffin of the 2-week long bull flags with a 'gap-and-run' lower, which now puts the May lows under pressure. If bulls are to get out of this with the prospects of a double bottom then today or tomorrow has to see a spike low, preferably one with a wide intraday range which capitulates the last of the weak hands. But if we see another day like Friday, then it's back to the drawing board as to looking for a bottom. For the Nasdaq, we have the May spike low of 11,035, but really, it's the candlestick real body support of 11,152 which has to hold on a closing price basis - spike lows below this are fine (and are to be welcomed). We have technical pressure with the uptick in bearish trend strength, the relative 'sell' trigger against the S&P, the 'sell' signal in On-Balance-Volume, and a weak 'buy' signal in the MACD which i