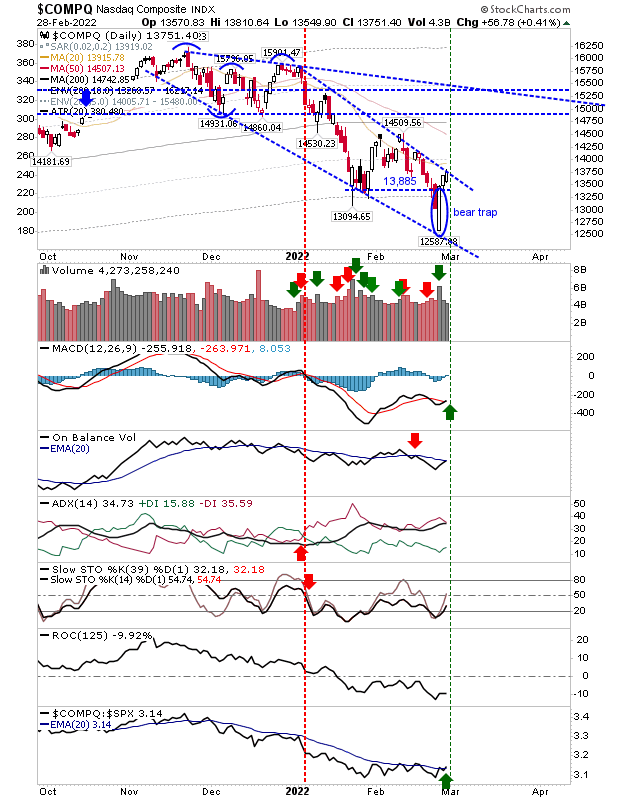

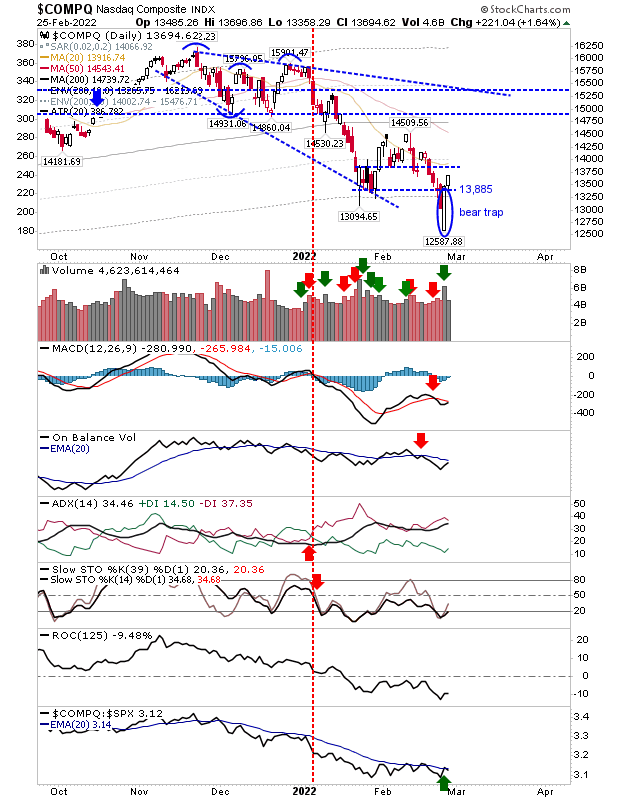

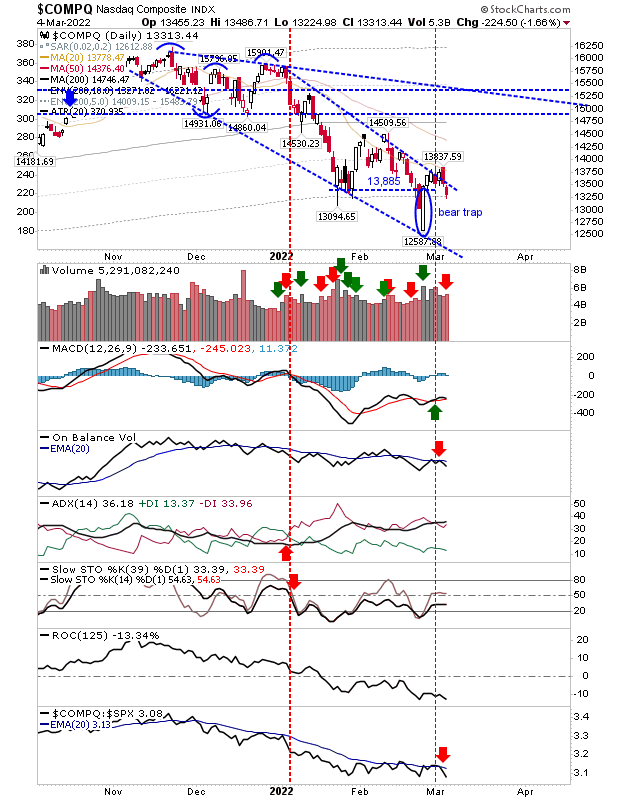

Now, we will see how strong the late February reversal is

After the big surge off February lows on higher volume accumulation. Now, we will see how robust such demand is with markets edging back towards February lows. The Nasdaq is looking the most vulnerable as it has already cut below support which defined the 'bear trap'. The breach was relatively minor from a price perspective, but it did come with a higher volume distribution and a 'sell' trigger in On-Balance-Volume. Relative performance took a sharp tick lower. Again it's early days and the bullish reversal is not immediately at risk here.