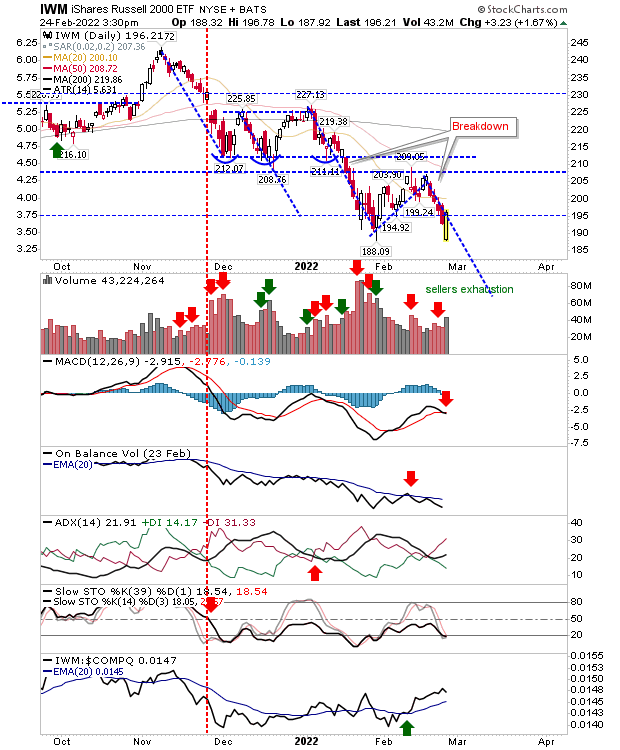

A bottom for the Russell 2000?

War has begun and Covid is near an end; I can only assume traders are 'buying' the war as I would expect the Covid rally to be sold when the virus eventually peters out. The Russell 2000 ($IWM) looks to offer the best value as the current leg down as suffered none of the heavy volume trading the initial leg down in January experienced. Today's white candle reversal did register as accumulation for this index - another reason to be positive (unless you live in Ukraine). Also, with today's low at $187.92 the index is well placed to map a double bottom with the January swing low (with supporting bullish divergences in the MACD and Stochastics). Technicals are net negative, aside from continued relative gains against peer indices.