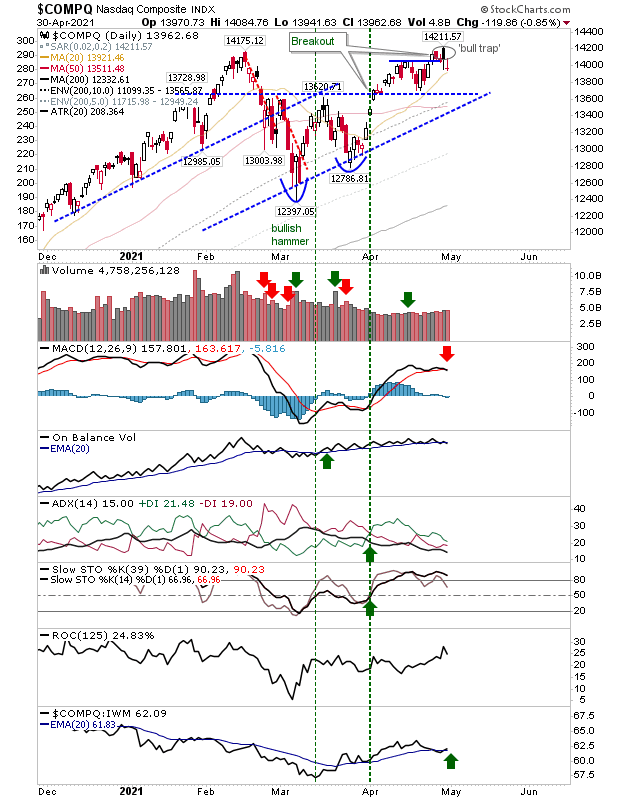

Nasdaq holds rising trendline

There was a big up in trading volume and today's action ranked as distribution, but for the Nasdaq it was not enough to deliver a loss of trendline support or its 50-day MA. However, technicals are growing bearish with 'sell' triggers in the MACD, On-Balance-Volume and ADX - not to mention, a relative loss against the Russell 2000.