Sellers hit Nasdaq and S&P 50-day MAs

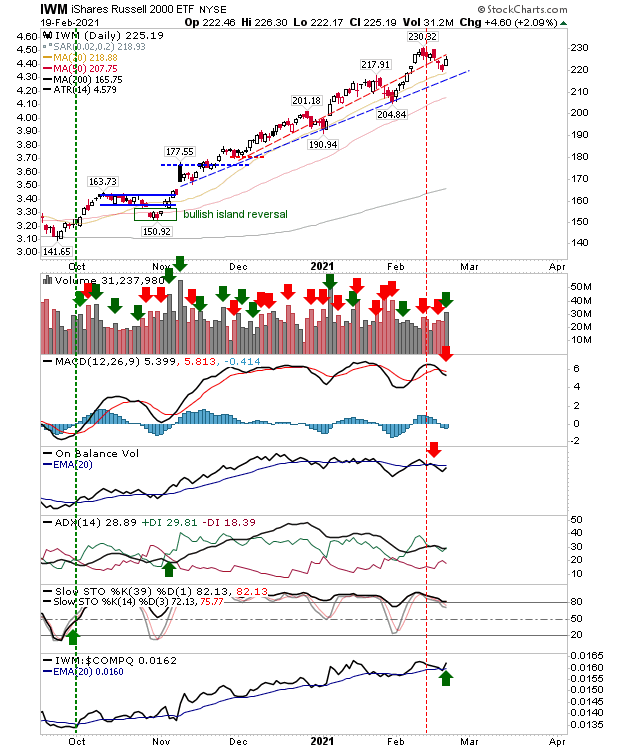

Perhaps a degree of complacency has crept into the market? Today's selling brought the Nasdaq and S&P back to successful tests of their 50-day MAs. What was concerning was the general lack of volume on what is typically an important support test for the indices. Both the S&P and Nasdaq were able to stage successful intraday recoveries, but again, volume should have been more to support it. What we need to watch for tomorrow are losses - typically from the open - that push down into today's spike low for the aforementioned indices. Particularly if this selling volume picks up relative to today. I would think any close below today's finish would indicate that today's lows (or the 50-day MAs.) will act as support for long. The Nasdaq probably did enough to defend trend support, although technically there was a big uptick in ADX, and the bearish MACD accelerated downwards.