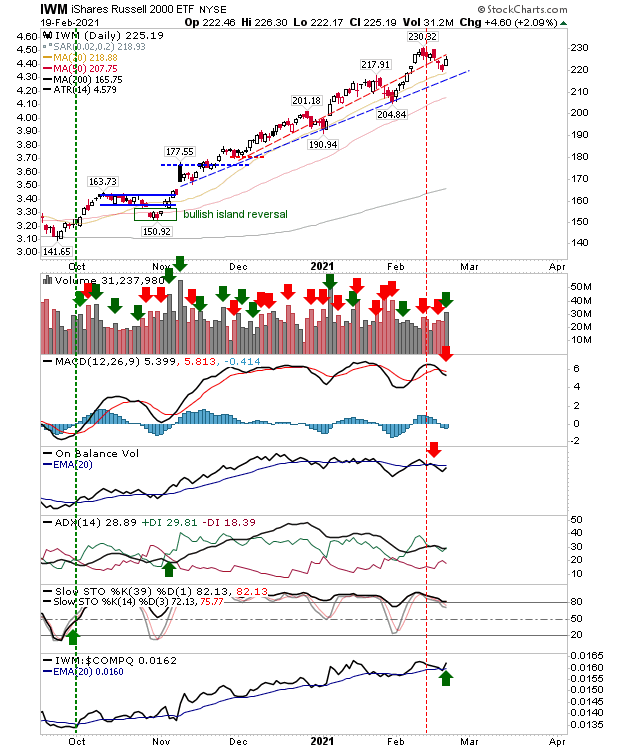

Russell 2000 ends the week on a high

After drifting towards a period of under performance relative to the S&P and Nasdaq, the Russell 2000 was finally able to post same gains to at least stall the weakening momentum. The Russell 2000 was able to make its stand at its 20-day MA on higher volume accumulation. However, it still has 'sell' triggers in the MACD and On-Balance-Volume.