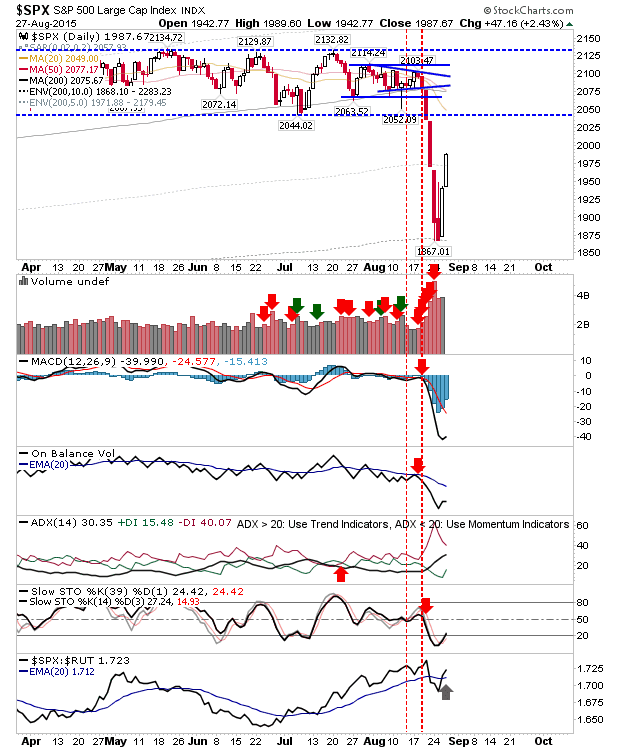

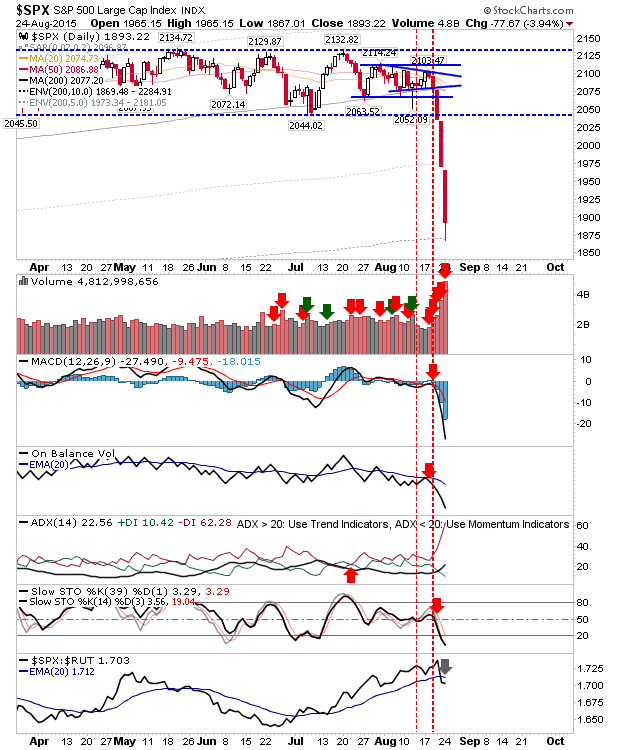

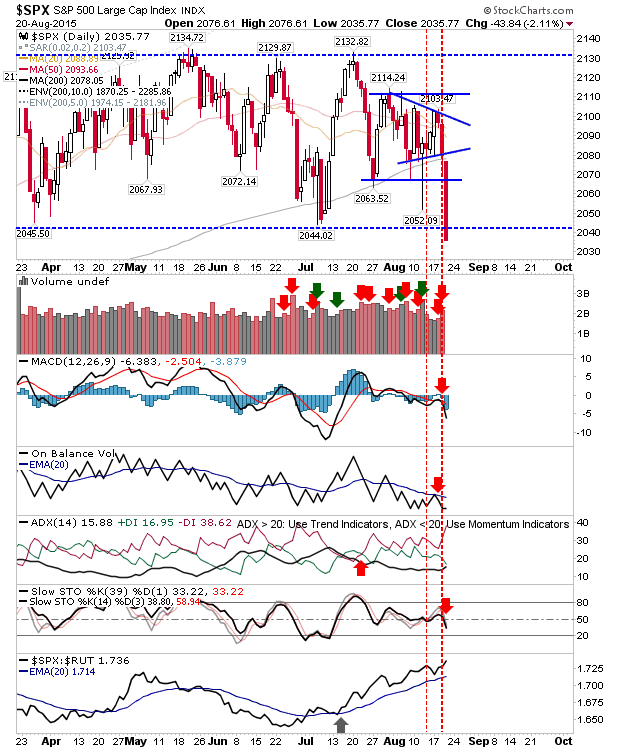

Tough day at the office with sellers having all of the fun until the Fed meeting minutes jacked up prices, only for sellers to return into the close. For the S&P, each test of the 200-day MA weakens it, and we are probably getting close to the point we get a decent push down, and a move outside of the longstanding trading range which has plagued this market throughout 2015. Even a modest 10% correction off highs would set it to drop below psychological 2000. Should such a move occur it should be welcomed like refreshing rain on a muggy day. The market needs direction. The Nasdaq dropped below 5,038, but 4,950 is key support - which is also close to where the 200-day MA is. Still plenty of places for buyers to step in, and this is not looking as vulnerable as the S&P. The key disappointment for Tech was the loss of support from what had looked to have been a bullish wedge in the Semiconductor Index. Technicals are again all net negative. The Russell 2000 had