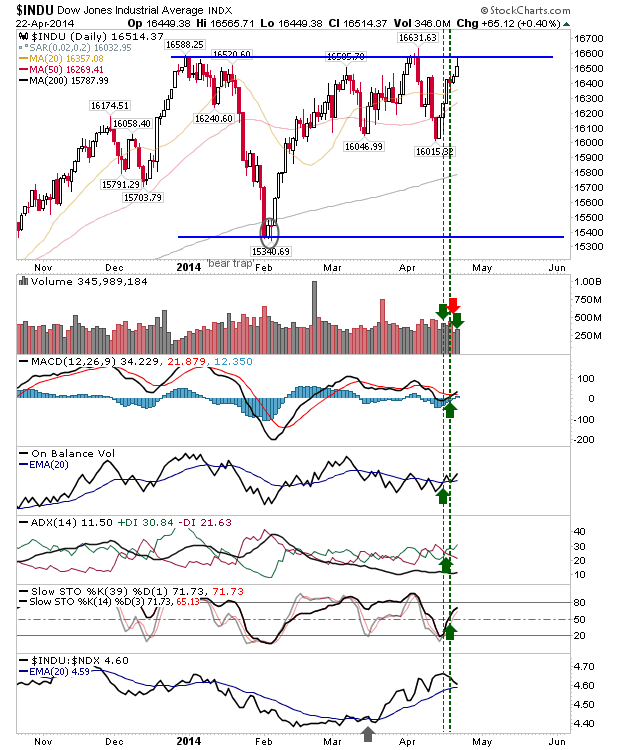

Daily Market Commentary: Dow on the Brink of a Breakout

It's probably down to the Dow to lead bulls out. Other indices are too far back to make a difference, and the S&P isn't close enough to suggest it will do the lead out. Volume climbed to register accumulation, a good sign for bulls looking for more. The Dow managed a picture perfect 50-day MA, and now could be at an all-time high by the end of the week.