Stock Market Commentary: Flat on Low Volume

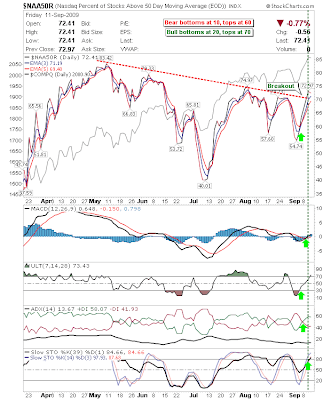

Thursday clsoed as a non-entity sort of a day. It could be argued the break of the Nasdaq channel stalled, to place it back on channel resistance. If the Nasdaq was to further drop then what happens at black channel support (closely in tune with the 20-day MA) will govern the level of demand from buyers. Certainly channel resistance is clearer to see for the Nasdaq 100 Semiconductors took a more serious hit, although Thursday's loss wasn't enough to violate former resistance-turned-support. On the sentiment front there was a bullish breakout (and bearish divergence negation) in the Nasdaq Summation Index; intermediate term picture strengthening on the bull side. Friday set for a lower open ; options expiration day to boot. Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts , stock charts , watchlist, multi-currency portfolio manager and strategy builder website. Forex data available too.