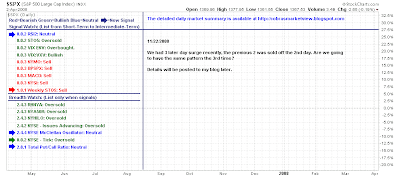

Weekly Stock Charts review

For the week that was - short as it was. What had the Stockchart.com ers to say about it? Yong Pan is looking for a higher low on the inevitable downward turn. More even split on bullish and bearish signals: Technicals set for a downward move; VIX oversold, CPC also in bear zone. But intermediate time frame looking good for a 'buy': Yong Pan has quite a few other charts worth seeing; particularly his Bonds:S&P relationships with NYAD resistance. Maurice Walker has eys on the next automaker grilling. Doesn't believe the worst of its has been priced into the market. But, has noted markets breaking resistance: Based on improving technicals and market breadth, it is my personal belief that the market will rise off these oversold levels on the daily chart. Now clean out your ears, and hear me correctly! THAT DOESN'T MEAN WE ARE GOING TO CONTINUE HIGHER WITHOUT PULLING BACK FIRST. The DJIA has just had it's best 5-day winning streak in 75 years. We are overdue for a