New Year, New Opportunities

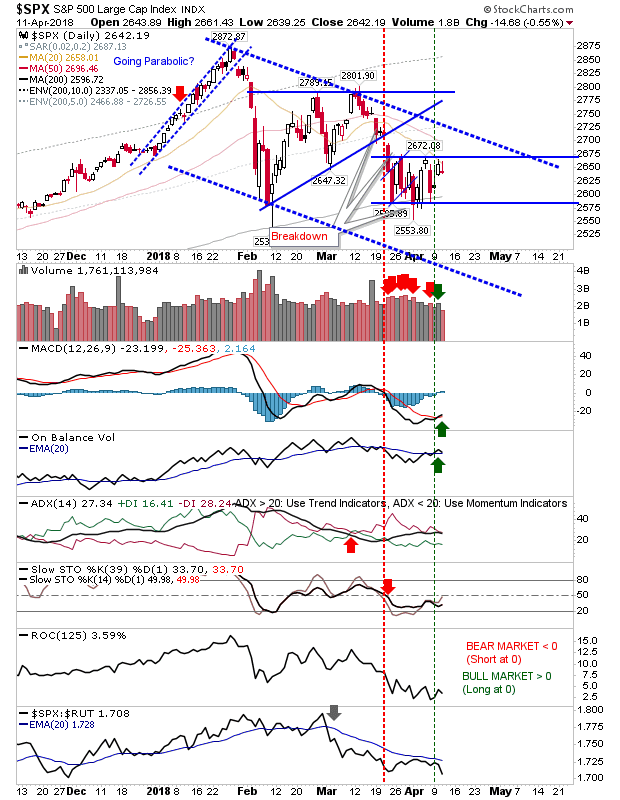

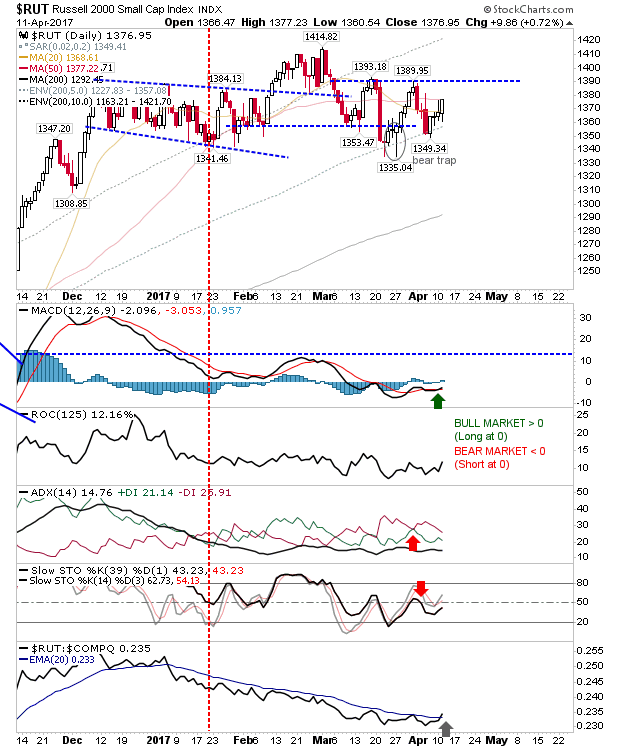

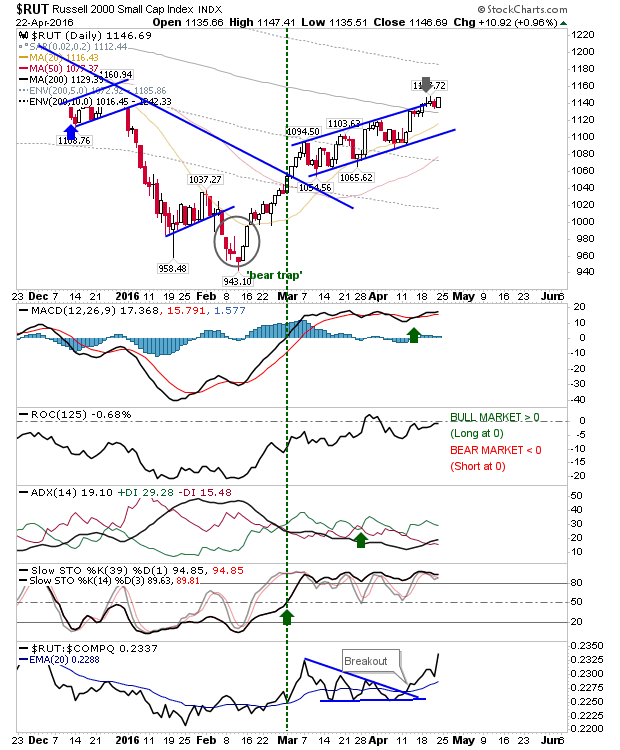

2017 opened with a positive start on higher (albeit low) volume accumulation. The late flourish in the market following the election results helped close 2016 on a positive note. So what will 2017 bring? The S&P wasn't able to hold the bulk of Tuesday's gains, but it did reverse the damage from last Friday. Not surprisingly, recent volume has been very light so it will be important to see how this changes as traders go back to work. The only technical change over the holiday period was a 'sell' in the MACD.