Sellers control the week

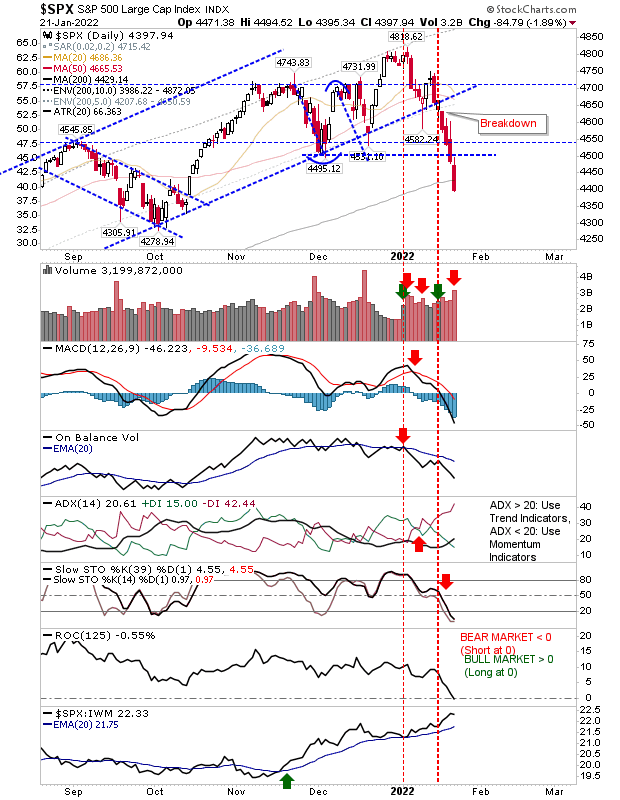

Options expiration disguised some of the selling volume, but Friday was still an ugly day for markets.

The Nasdaq wasn't able to stick around its 200-day MA for very long and once that support was lost it became hard for buyers to drum up any enthusiam. Technicals are net negative and the index is sharply underperforming relative to the S&P.

The S&P did make it to its 200-day MA on Friday and then promptly closed below it. Given the sequence of losses there is a good chance we will see some kind of spike low/bullish hammer with a close back above the 200-day MA. It looks like a logical place for a trade, but whether the resulting bounce will last longer than just a few days will remain to be seen.

The Russell 2000 ETF ($IWM) pushed through some heavy volume on Friday as it finished just a few point shy of the measured move target I outlined in the middle of December. As with the S&P, there is probably a good chance we will see some form of bounce shape up once this target is reached.

The Dow Jones Index lost a little more ground than the S&P, but it's coming up close to a support level around 33,900 - marked by a double bottom in September/October and a near test in December. If it can bounce from here, then I would be looking at a possible trading range with 36,500 the upper price for this range.

For next week, we would look for bounces from support tests - potentially kicking off on Monday. The S&P will be the first such opportunity, the measured move target in the Russell 2000 is likely to be the other.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.