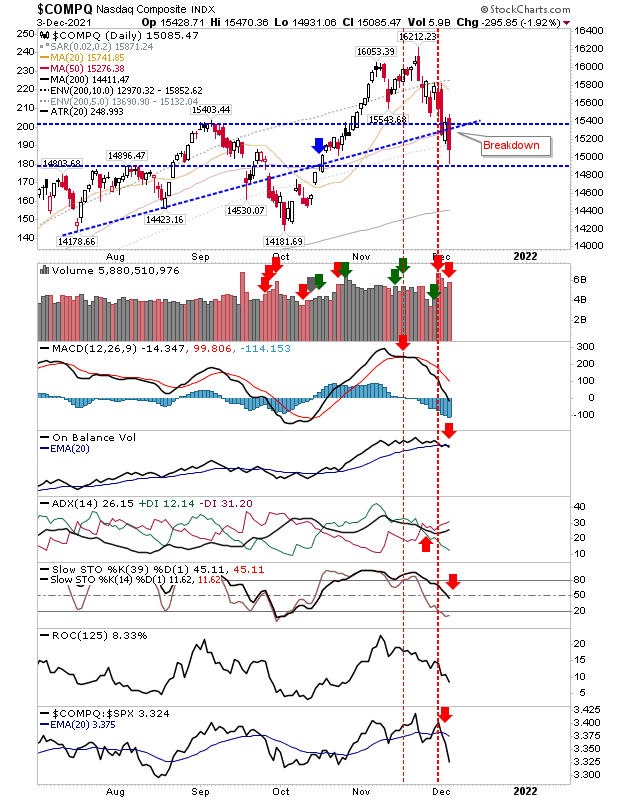

Nasdaq breaks support as the Russell 2000 continues to fall

Indices continue to fall as traders grab profits before the holidays. While the Russell 2000 is the index feeling the most pain it handed the headlines over to the Nasdaq on Friday when it undercut its 50-day MA, on higher volume distribution. Technicals are net negative, but internediate term stochastics are not oversold. The index is underperforming relative to the S&P as it works its way towards its 200-day MA.

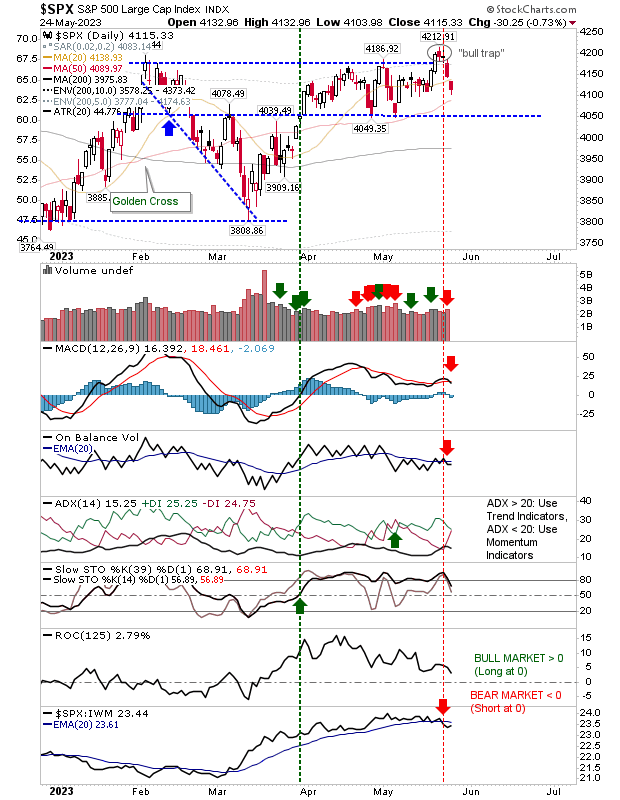

The S&P did lose ground on Friday but remained above breakout support and its 50-day MA. Stochastics are holding the mid-line support level which is the last stand for a bull market; lose this and it will likely take a move to the 200-day MA before these stochastics are oversold (the next opportunity for a bounce).

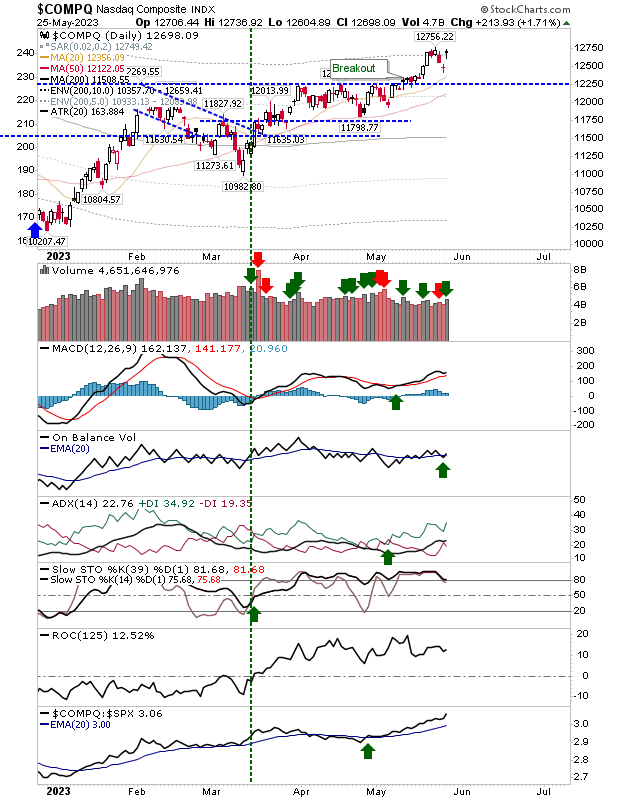

The Russell 2000 has long since said good-bye to its 200-day MA and is now looking at former trading range support. I doubt the latter will hold as in most 'bull trap' reversals, former range support rarely comes to the rescue - and a clean slice through is a more probable outcome. Things are looking ugly for the Russell 2000.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.