Markets work on breakout support tests

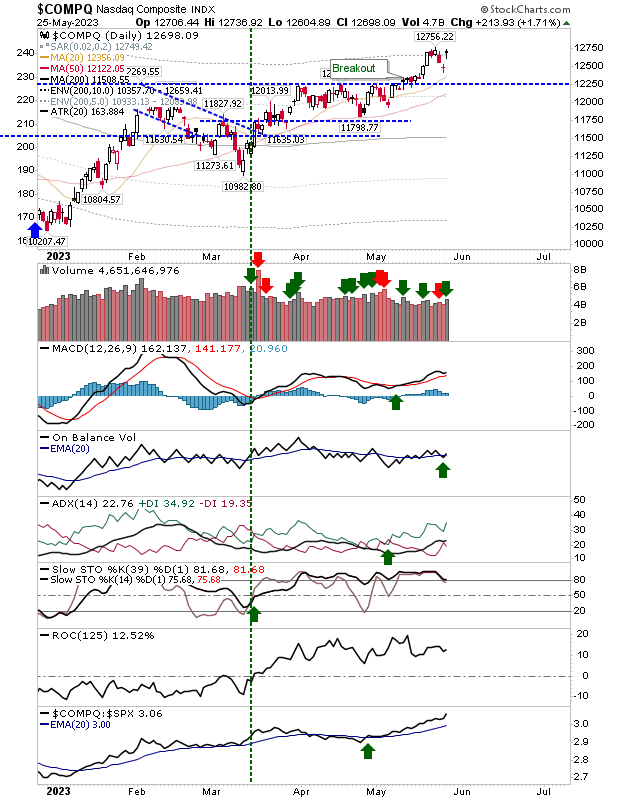

Sellers struck for a second day as the Nasdaq and S&P experienced the first real pull back since rallying off October lows. There is still a few days before we get to test breakout support but what we have so far is healthy - especially as selling volume has come in below prior buying.

The Nasdaq will likely make it back to support first.

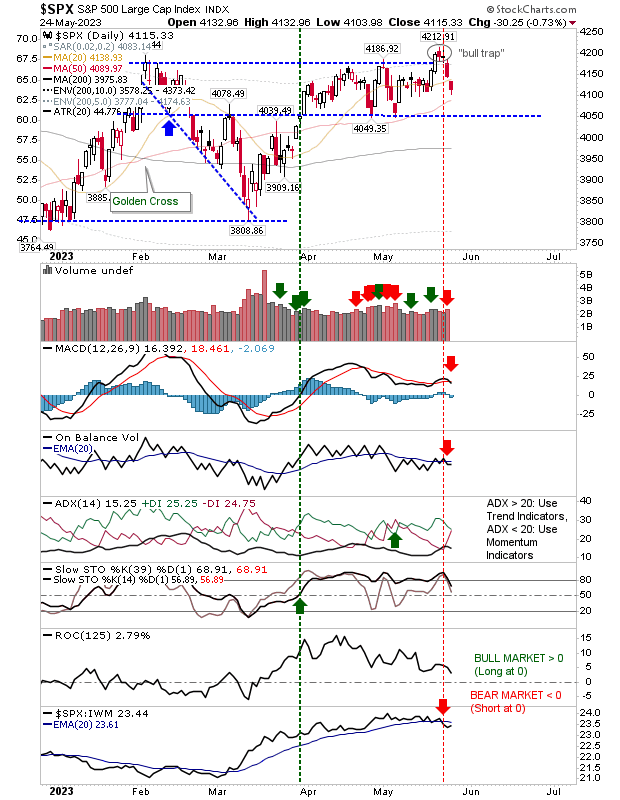

The S&P remains well above breakout support and will likely leave a few more traders fretting on their positions if the index continues to fall. While the index is still underperforming relative to the Russell 2000 it was able to make up some lost ground on that index.

The Russell 2000 has spent the year trading sideways, so now that it has cleared its trading range it has an opportunity to establish a new rally. But with today's selling it may take a little longer for it to gather steam. Key is holding above $232 support ($IWM).

We now have to see how these markets react. Ideally, we don't want to see a pick up in volume should sellers retain control; better still would be a spike low with a surge in volume on the buying recovery (e.g. on a test of breakout support). The index I'm most interested in is the Russell 2000 ($IWM). Tech and Large Caps have had their time in the sun, but the Russell 2000 is only starting to get going.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.