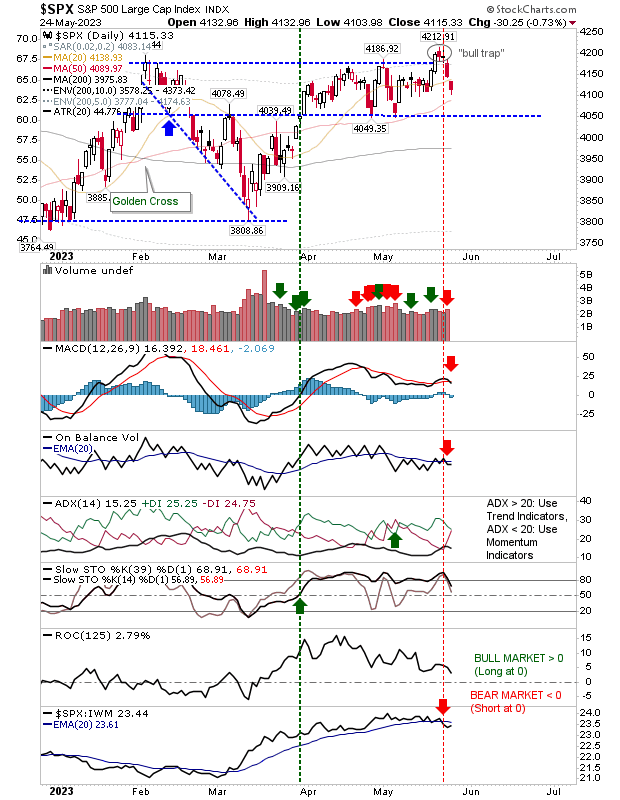

S&P pushes lower as Russell 2000 tags 200-day MA for a third time in two months

The S&P followed through on its continuation pattern by delivering a solid red candlestick lower. Those big red candlesticks have also come with bearish distribution. Next stop is the 200-day MA on net bearish technicals.

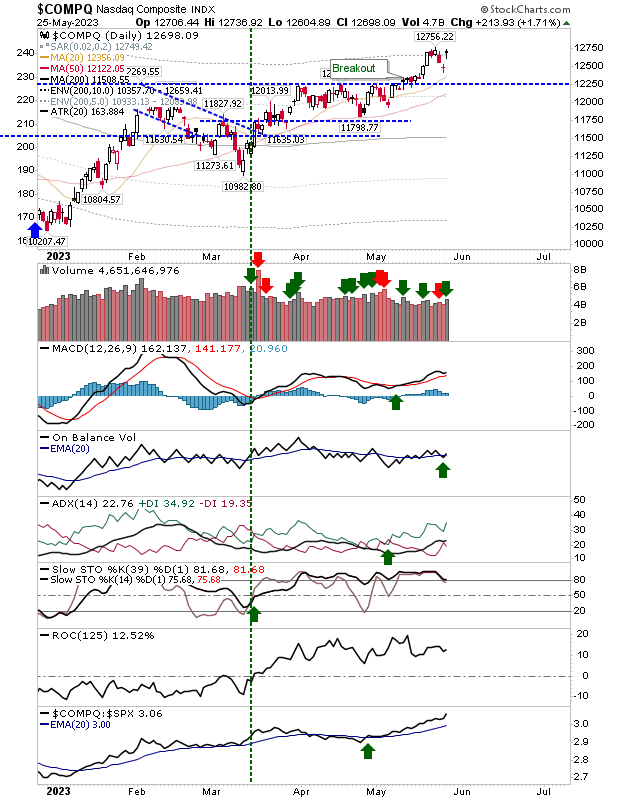

The Nasdaq is also edging towards its 200-day MA on higher volume distribution. With the index closing at its lows over the last few days its likely to keep pushing lower. Watch for a spike low as it gets closer to its 200-day MA.

The Semiconductor Index is supporting the move lower in Tech indices as it too has broken rising trendline support. As with the Nasdaq it's also gearing for a test of the 200-day MA - but is likely to get there first.

The Russell 2000 hit its 200-day MA for a third time in the last two months, but all of this has occurred within its larger trading range. If there is an undercut then next test will be trading range support - opening up the possibility for larger losses.

Today's action has effectively set up for further losses - most likely tomorrow. Larger losses may emerge later but we likely haven't seen the end of the selling yet. The Russell 2000 remains the index of interest as it has shifted sideways for most of 2021 as other indices gained. How it breaks will say much about the long term trends for markets.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.