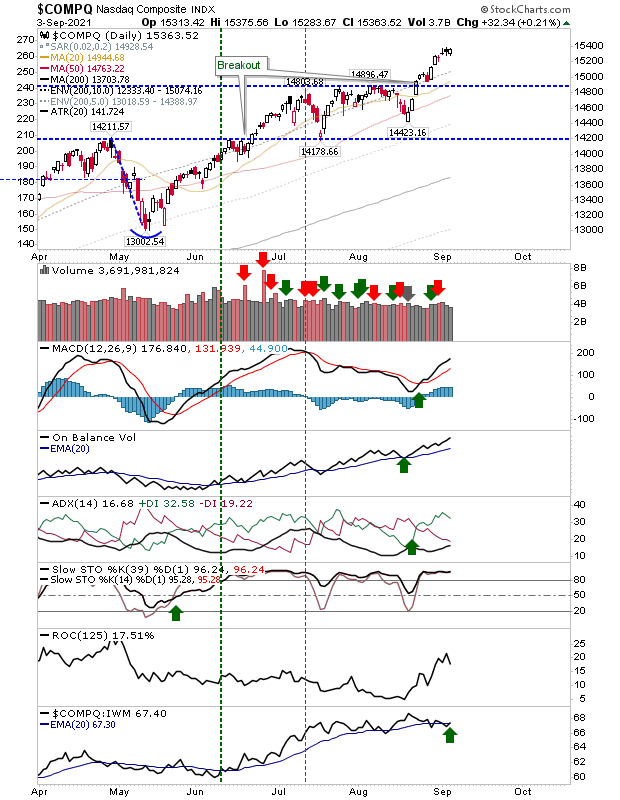

Nasdaq leads as Dow maintains breakout

The Nasdaq managed to emerge with a small gain on Friday which was enough to return the index to its leadership roll. Technicals are net positive and despite Friday's lower volume it remains well placed to push on.

The S&P has been edging higher in a manner which makes it easy for long term players to hold and not much for anyone else.

But its the Dow which is offering more for traders as its breakout is close enough to support to offer a more attractive risk:reward.

Heading into next week we will want to see the Russell 2000 continue its advance towards resistance and eventual breakout. Should it do so it will offer a welcome shot in the arm for Large Cap and Tech indices - the former in particular needs some volume.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.