Flat-line Day for Markets

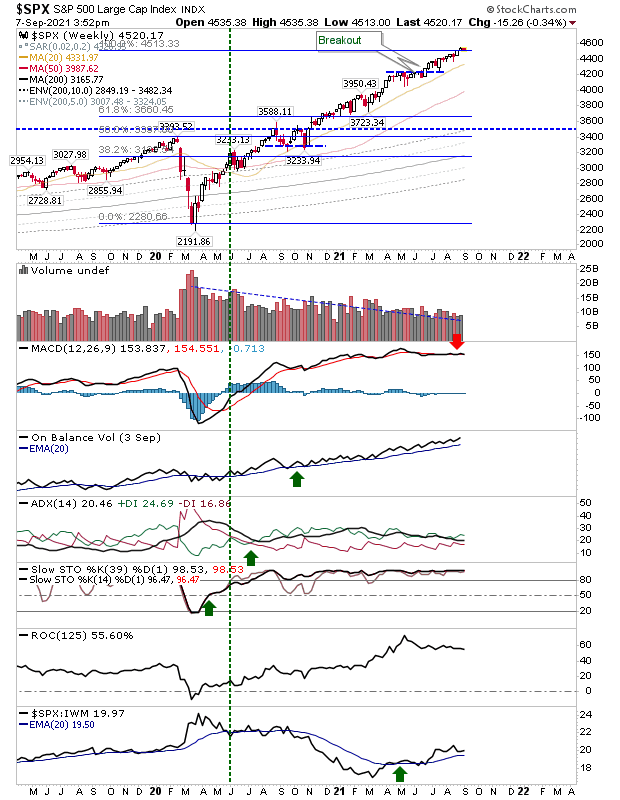

Most of the attention will have been on cryptocurrencies today, but for markets, it was another dull day. The S&P barely moved the needle as it continued its snail-paced ascent. It's weekly MACD has effectively flat-lined with only its accumulation trend in On-Balance-Volume showing signs of bullish life.

The Nasdaq closed with a narrow bar candlestick as the rate of its ascent slowed. The index is showing a relative performance advantage over the Russell 2000, which marks a shift in favour of Tech stocks over Large or Small Caps.

The Russell 2000 lost a little ground as it looks to build a challenge on $233 ($IWM). Technicals are net bullish as the index looks to negotiate its trading range.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.