S&P and Nasdaq at new highs

Finally, we got to see some movement in the S&P and Nasdaq as both indices finished with new closing highs.

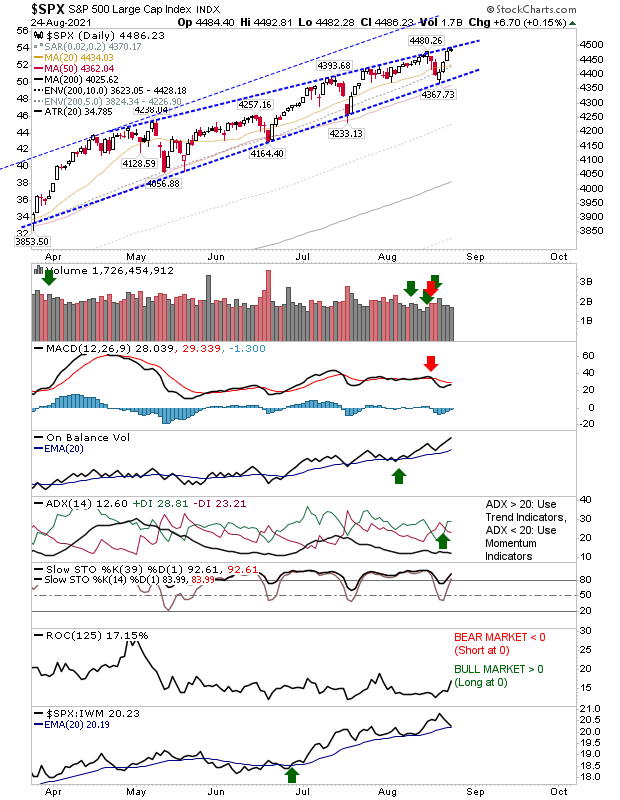

For the S&P there is still the potential issue of the bearish wedge as the index closes at its resistance. Technicals are mixed, although it's holding on to its relative performance advantage.

In the case of the Nasdaq there was a clear breakout (albeit on light volume). Technicals are good, including relative performance.

The Russell 2000 continued its recovery as it approches the 50-day MA which has proved to be such a challenge before. Volume has steadily dropped on the advance. It will need to pick up on a push above the 50-day MA. Technicals remain net negative despite the gains, marking this a potential 'dead cat' bounce.

The bounce in the Russell 2000 is facing its first big test. Given the move to new all-time highs for both the Nasdaq and S&P there is a chance for the bounce in the Russell 2000 to succeed. I remain skeptical but with price as our lead we have to respect moves in Tech and Large Cap indices. Watch for 'bull traps' but so far, so good.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.