Yin and Yang; Russell 2000 manages small gain

The Russell 2000 was one of the better performing indices on the day, but it didn't change the larger picture of an index caught in a trading range. Today's gain was enough to see a new 'buy' trigger in the MACD as it closed on its 20-day MA. However, until it makes its way back to trading range resistance it's hard to be optimistic - or pessimistic - as to its potential outcome. Near term traders could trade from here for a move to channel resistance, but the whipsaw risk is high because of the trading range.

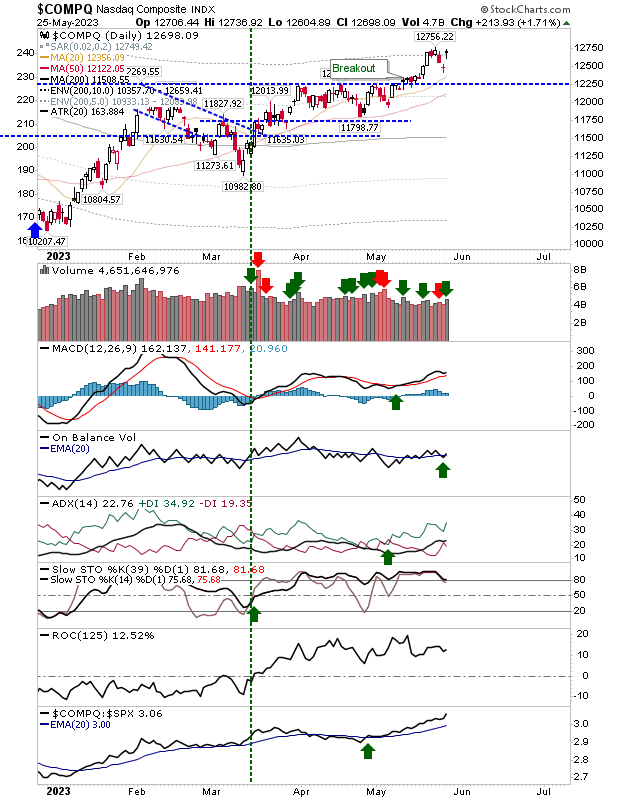

The Nasdaq recovered some of its losses as it made it bounced off its 20-day MA. The rally is a mix of bullish technicals for On-Balance-Volume, and a bearish one for the MACD. However, while its easy to be pessimistic we have yet to see concerted selling in the index. The index continues to outperform the Russell 2000.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.