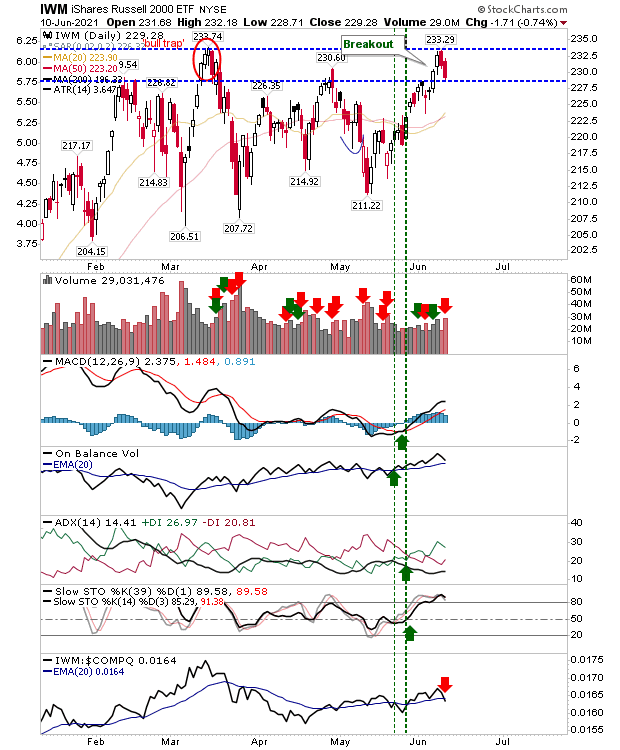

Small Caps confirm support with test

A bit of a mixed bag with the Russell 2000, having enjoyed prior strength, now finds itself in the process of back testing support - with the $229 level key. Volume rallied to mark distribution to go with a relative underperformance to the Nasdaq. Strength in the Russell 2000 is key for the broader averages but we need to see a bounce here if we are not to see a return to the prior trading range (of March-May).

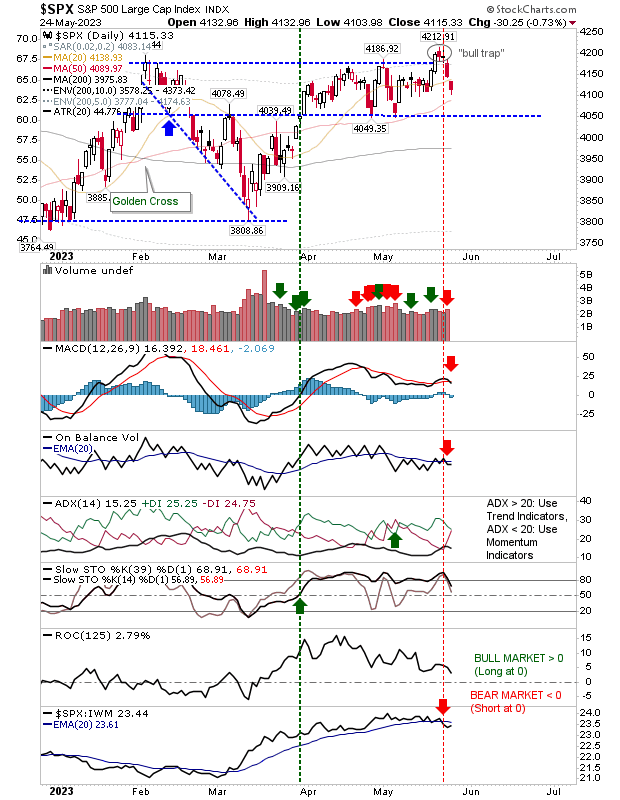

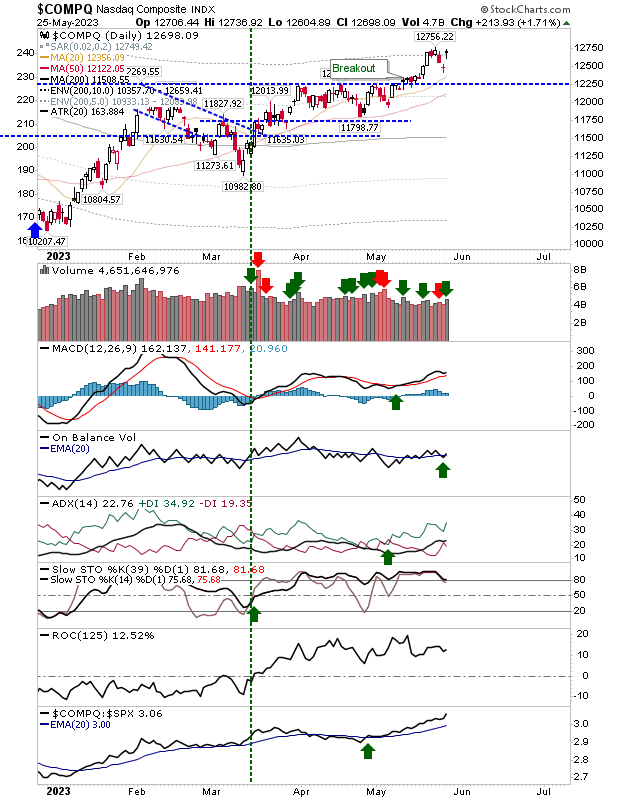

The Nasdaq edged a little higher as it rides along former support turned resistance. Just as the Russell 2000 is at a decision stage, so is the Nasdaq where a strong gain will have the dual benefit of clearing both boundary resistance and negate the April 'bull trap'You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.