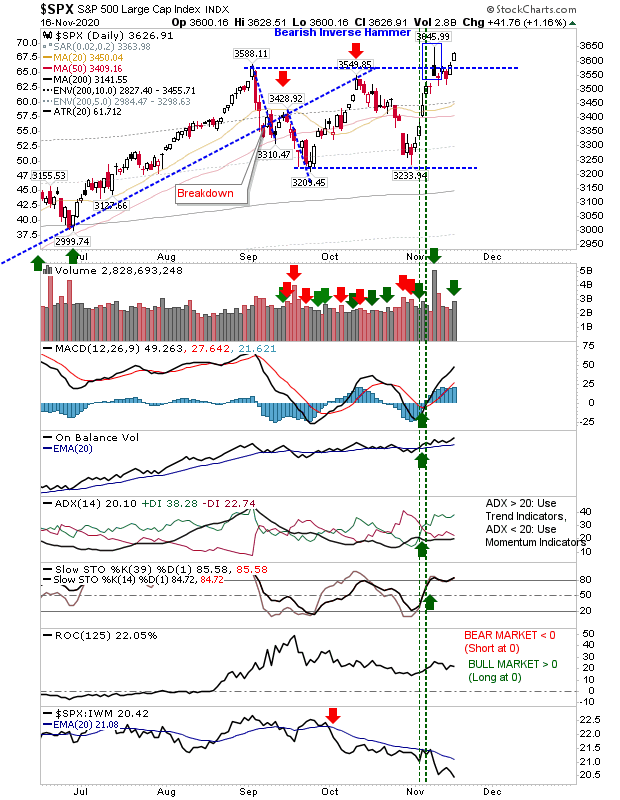

S&P and Nasdaq Again Can't Get Past September Highs

Why the focus on the September highs? Because they came with extremes in breadth metrics for the S&P and Nasdaq - marking levels typically associated with a major top. The action from Monday had looked like it was going to end the consolidation established from the September peak but again it was not to be. Today is not the start of a crash, but it is disappointing. The S&P is back at breakout support on the back of heavy volume distribution. The loss added to the relative loss against the Russell 2000. While today marked a loss, the presence of support hasn't totally negated bullish opportunity.