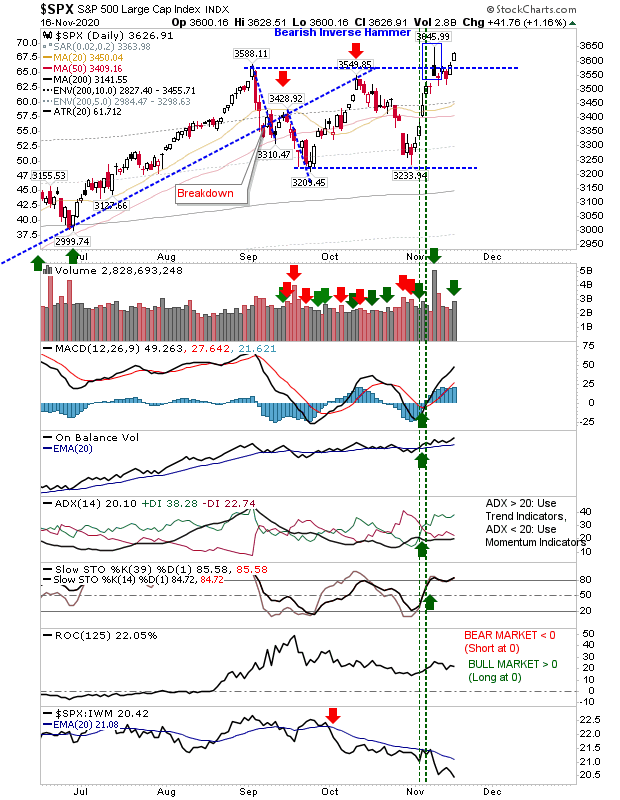

Indices Recover Lost Ground

Another bright start to the week on more positive Covid19 vaccine news. Today's gain was accompanied with higher volume accumulation across indices, setting them on course to negate the ultimate bearishness of last Monday's candlesticks - despite the initial positive vaccine news then. For the S&P, while today's gains pushed it well inside the spike high of the inverse bearish hammer, relative performance against the Russell 2000 took a big step lower. Under these circumstances, this may be seen as bearish but Small Cap leadership is critical to the success of any long term bull market. We will have to wait and see what the rest of the week brings.