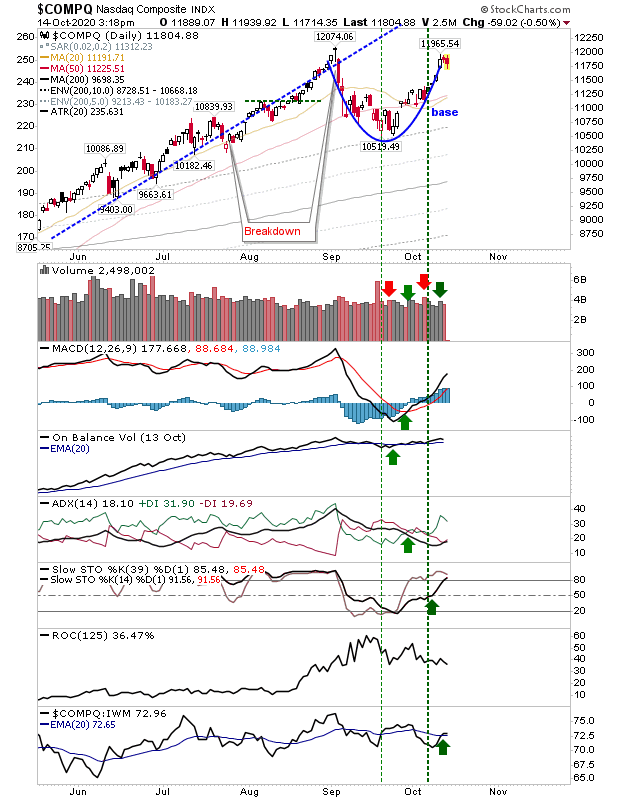

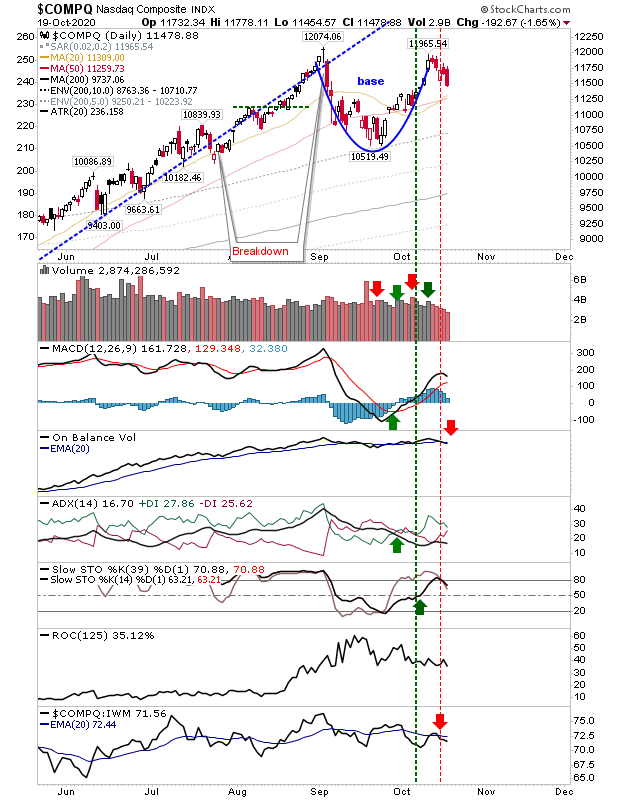

Selling Accelerates But Volume Remains Light

There was a pick up to Friday's selling, but while the one-day loss approached 2% for the Nasdaq and S&P it wasn't accompanied with the kind of volume such selling can typically scare up. The concern is that last week's peak for the Nasdaq morphs into a double top, but for this to be true there would need to be an undercut of the September swing low - and that could take well into November. Until then, we are looking at a sideways consolidation.