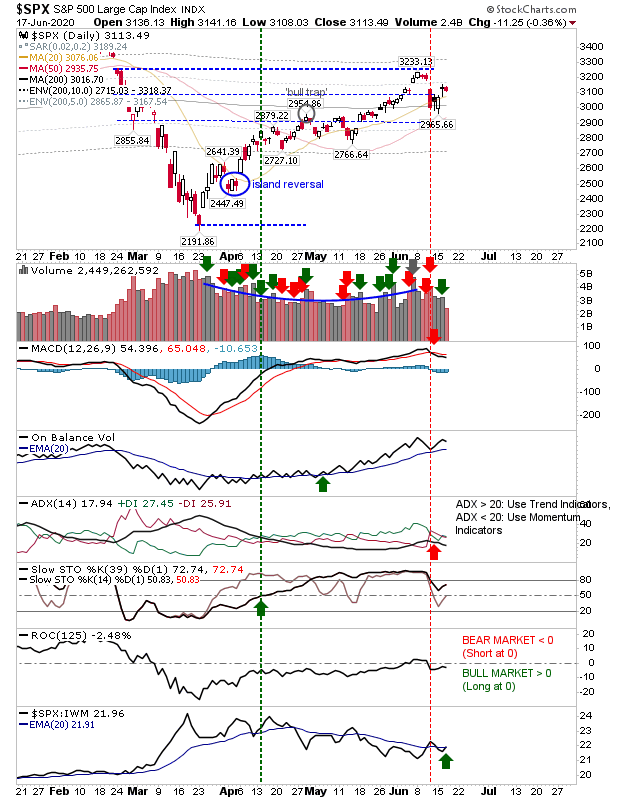

Sellers Take Control

The Nasdaq had been the lead index as it posted new all-time (post-Covid19) highs, but today's selling followed yesterday's bearish gravestone doji; collectively, it looks like a bearish evening star. The only thing remaining is breakout support, which has yet to be violated. Selling volume was down on yesterday's buying so it wasn't all in bears favor.