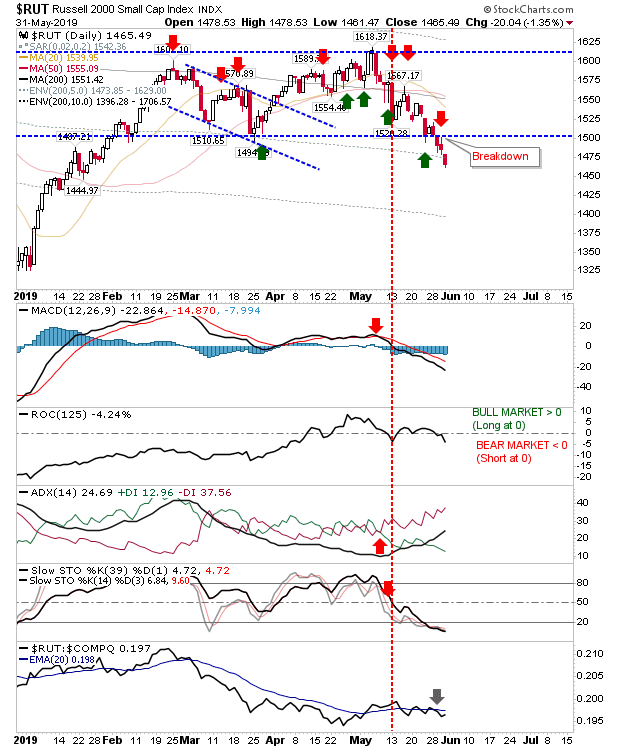

Breakouts for Russell 2000, Semiconductors and Dow Industrials

It was a bit of a mixed bag, although the basis for a probable swing low for markets is in place. Best of the action was in the Semiconductor Index where there was a clear break from the downward channel, which also coincided with a return above the 200-day MA. The consolidation below - and move above - the 200-day MA has the makings of a 'bear trap'. Next challenge is getting past the 20-day MA and if it can do this on the back of a MACD trigger 'buy' it will set things nicely for a challenge of the 50-day MA, then a larger challenge of the 52-week high at 1,604.