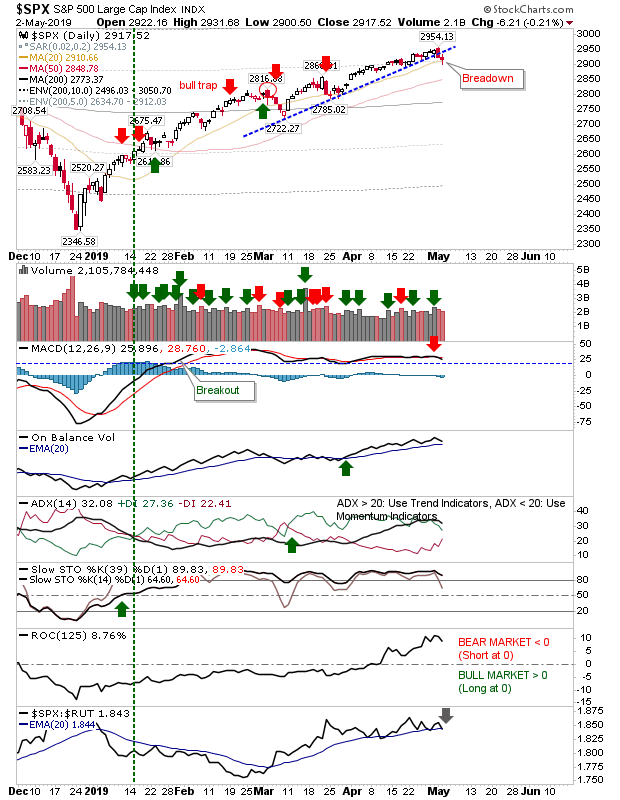

Technical Damage Across Markets

The to-and-fro of the US-Chinese trade war has left markets in a bit of a grey zone and facing uncertainty after holding moving average support. The S&P undercut its 50-day MA on higher volume distribution, but it also came back with a relative performance improvement. Technicals are net bearish.