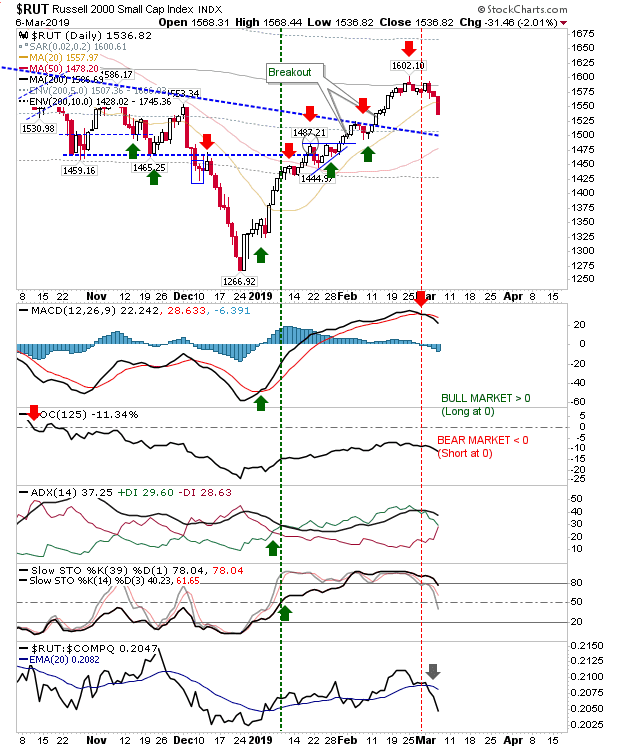

Russell 2000 and Semiconductors Crack

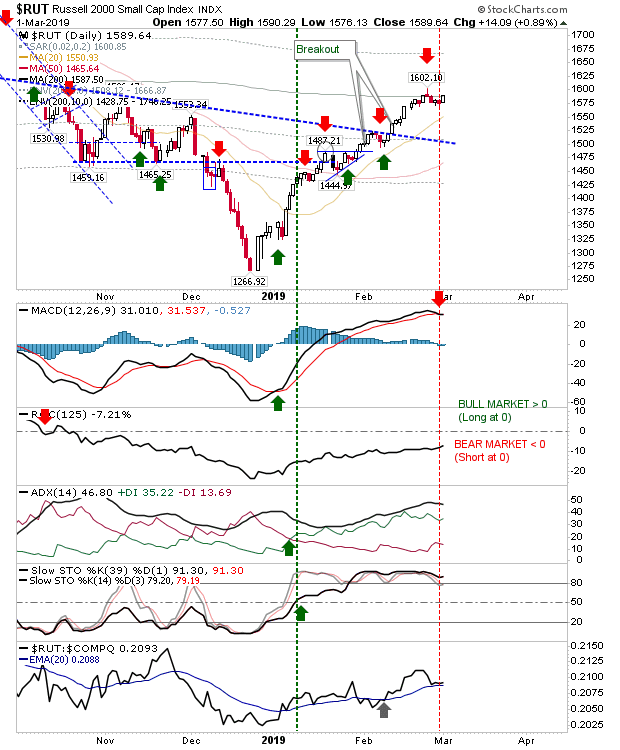

The Russell 2000 lost over 2% as it undercut the 20-day MA in a move which could pull the other indices down with it. The ROC is well below the mid-line and the -DI is on the verge of a bearish cross with its +DI following the earlier lead of the MACD.