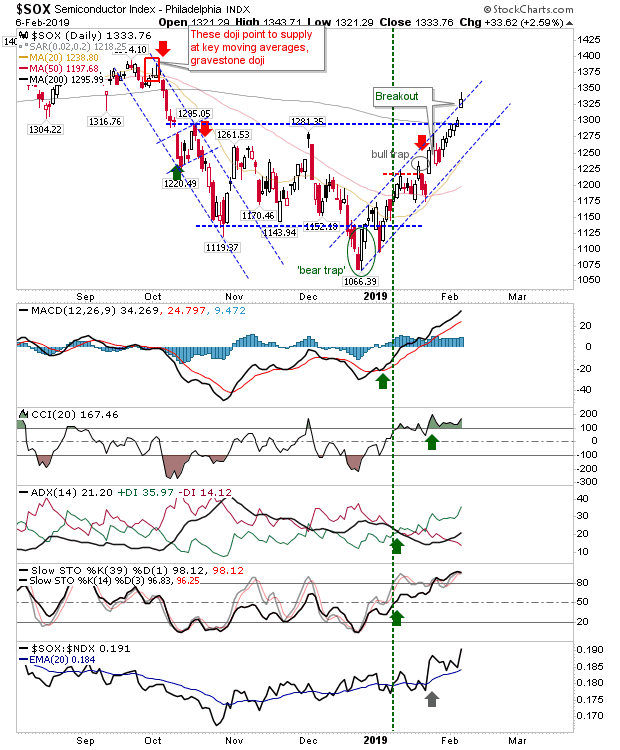

Semiconductors kick on as bounce reaches extremes

This bounce which kicked off in December has reached levels which are getting rich for many but not for the Semiconductor Index. The Semiconductor Index gapped higher which keeps it hugging the channel resistance line but also offers a buffer down to support; today's action registered as a breakout. Technicals are in good shape and relative performance is good.