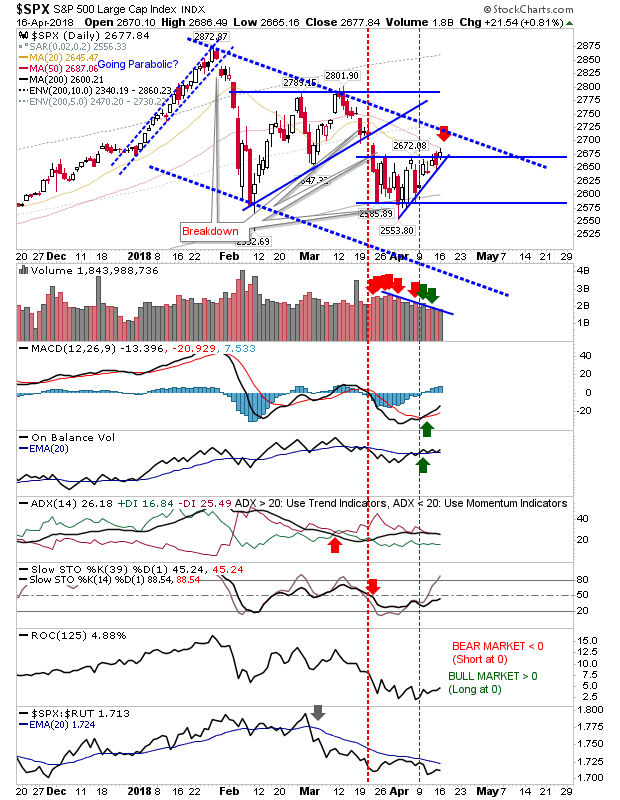

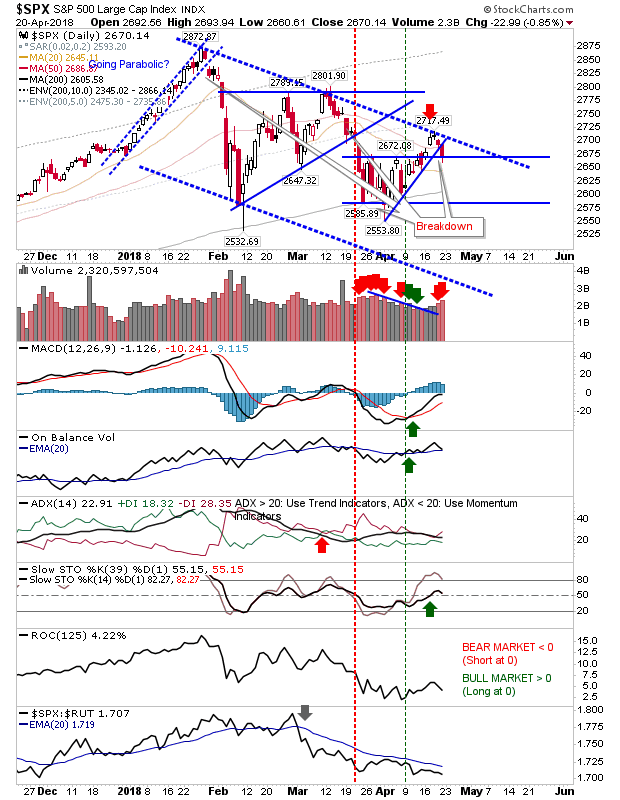

Shorts In Play

Friday's selling confirmed the second shorting opportunity with support breakdowns across lead indices. The S&P closed with higher volume distribution on a breakdown of rising support. Relative performance remains weak although there are still 'buy' triggers for MACD and On-Balance-Volume.