Shorting Opportunities?

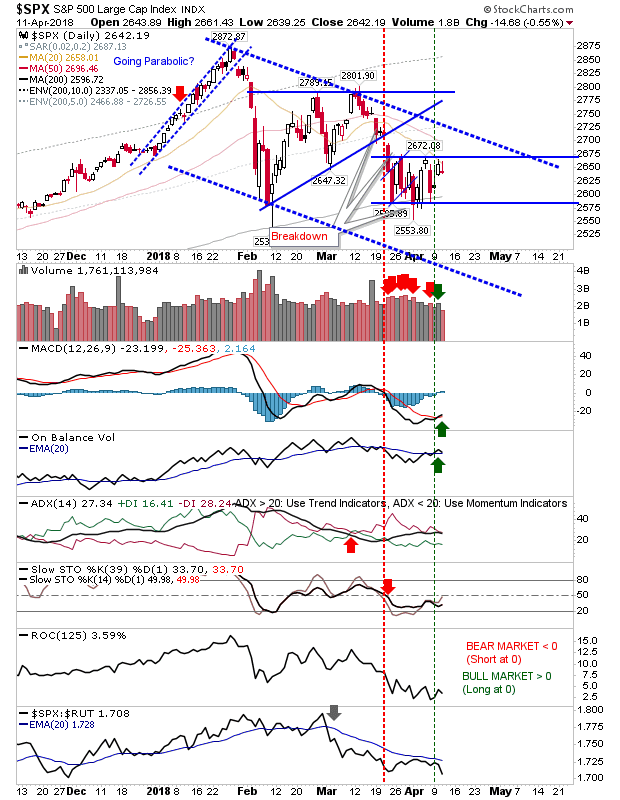

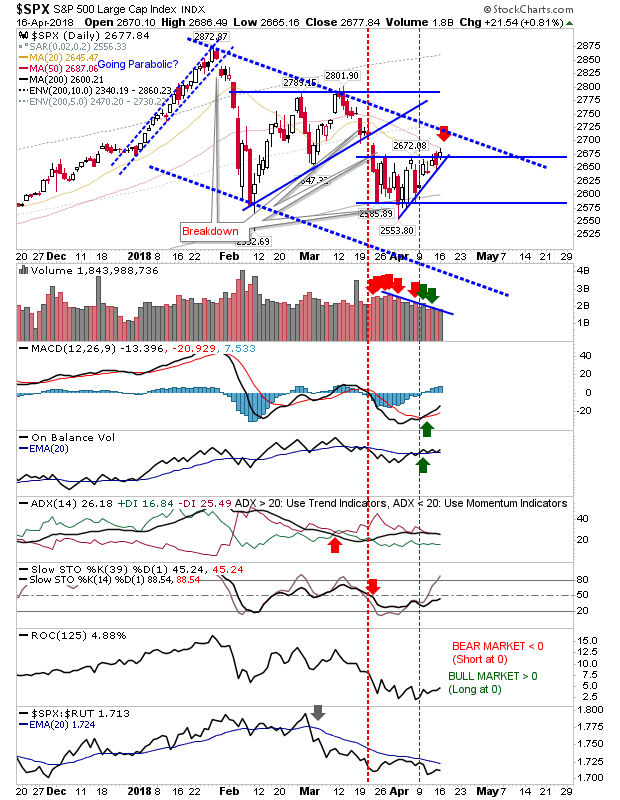

The indices are edging higher but the presence of 50-day MAs and/or channel resistance overhead does offer an opportunity for shorts to take a position. Market action does appear to be favouring bearish wedges with prices moving towards an apex on declining volume. The current apathy will break and how it does will define the direction of the next market phase. Today's action in the S&P left the index pinned to its 50-day MA. The tight intraday range offers a low-risk short play with a stop above the 50-day MA and an entry on the break of the ascending support line