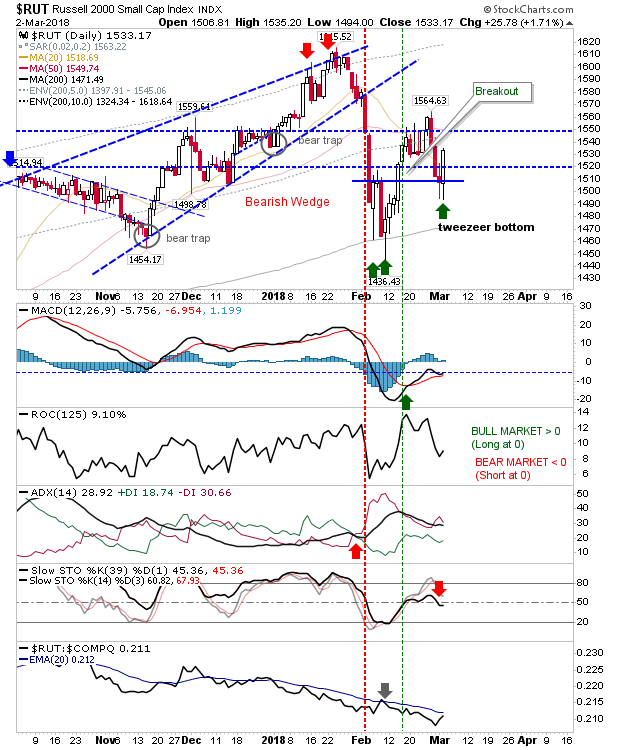

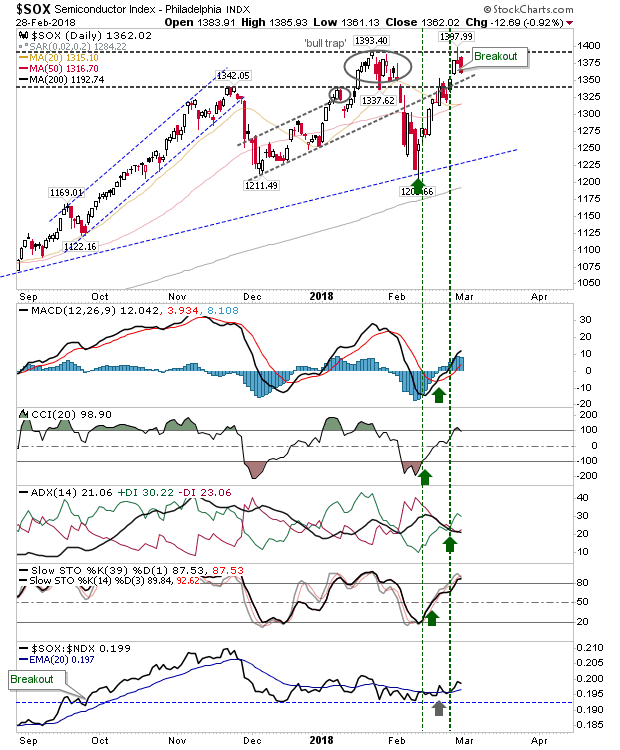

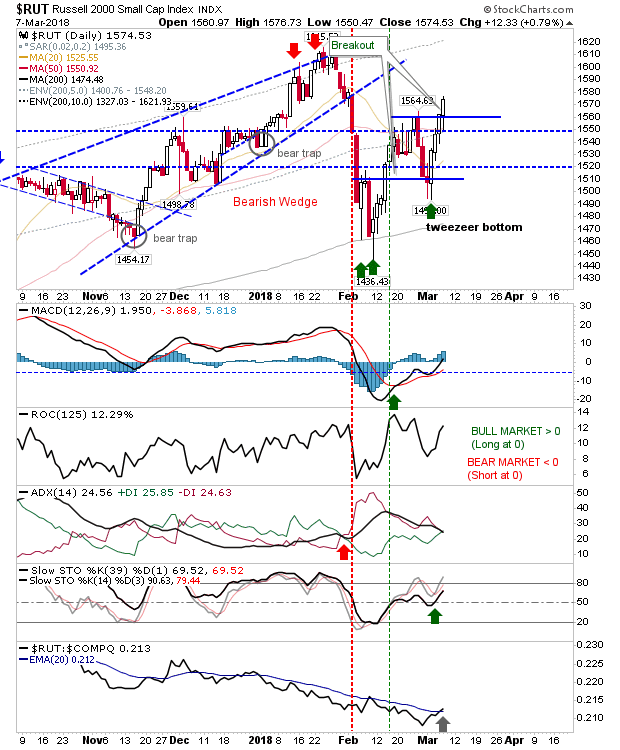

Russell 2000 Passes Last Swing High as Semiconductors Breakout

The Russell 2000 may not be the index pushing all-time highs but the last four days have seen steady gains for the index - enough to generate a new relative performance advantage against strong performing Nasdaq and Nasdaq 100. Leadership from Small Caps is critical for building long-term rallies and this is a good start and an excellent confirmation of the `tweezer`bottom.