Decision Made - Rush to Profit Taking

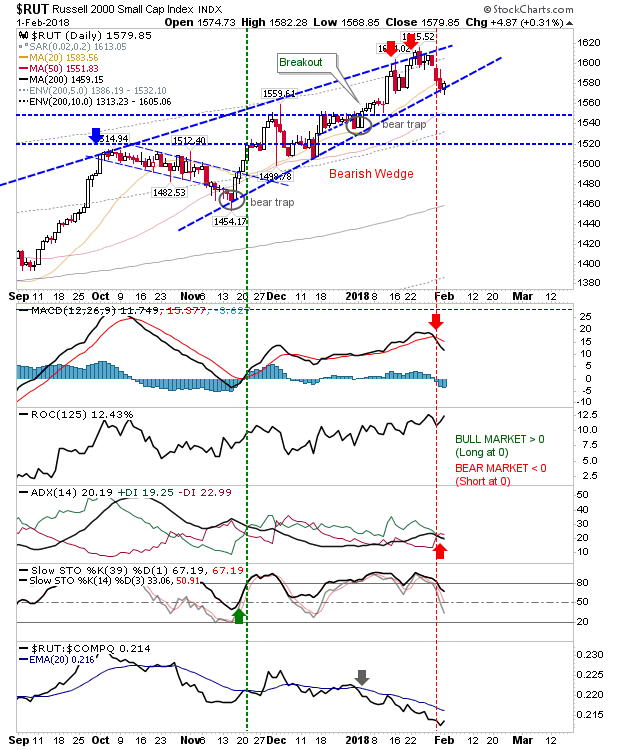

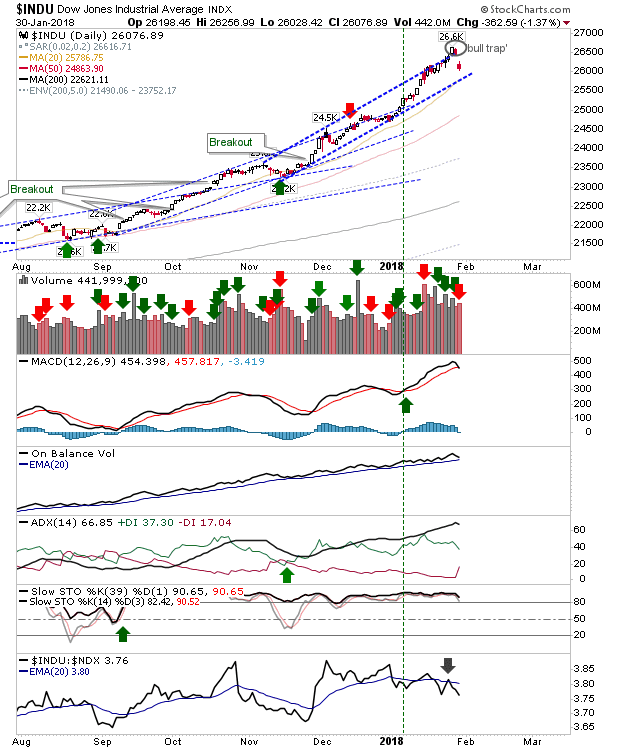

Having spent the weekend away I missed the initial breakdown but today was a clear rebuttal of the 2018 rally. The past two days have undone all of the gains of this year - undercutting slower channel support for many of the indices. The S&P climbed to register as distribution with a net bearish turn in technicals. Next downward target is the 200-day MA around 2,530.