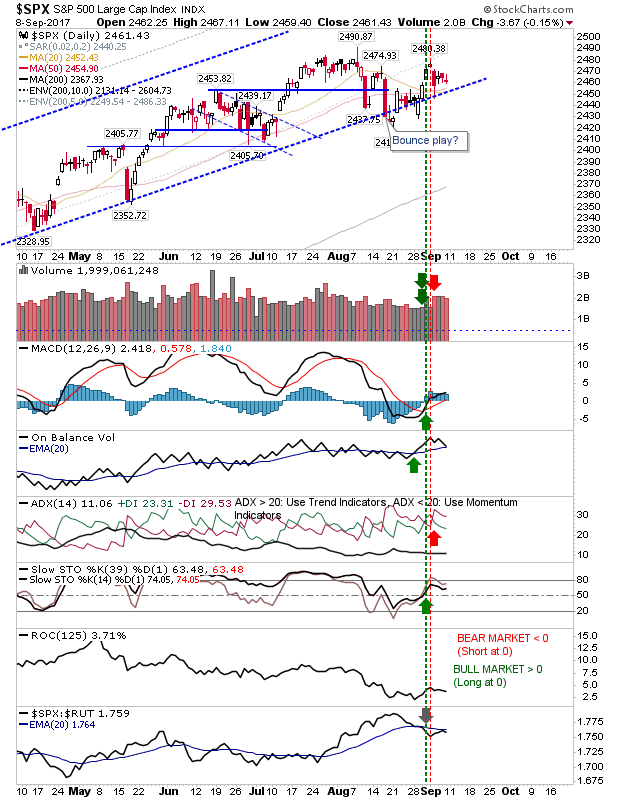

Dow Follows S&P Breakout

It was a bit of a slow burn day. The S&P held its ground and its breakout without generating significant weakness. However, the Dow managed to post a new closing high although the percentage gain is low and volume was below average.