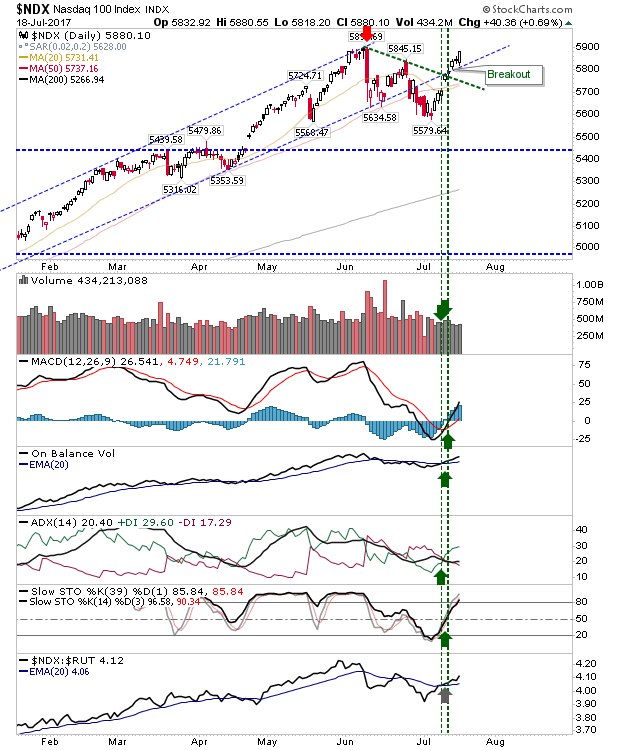

Breakouts Hold

While little happened over the last couple of days since the breakouts, enough was done to hang on to these gains. Tech had the best of the action, pushing away from support and consolidating the bullish position. Volume wasn't spectacular but not surprising given the summer season.