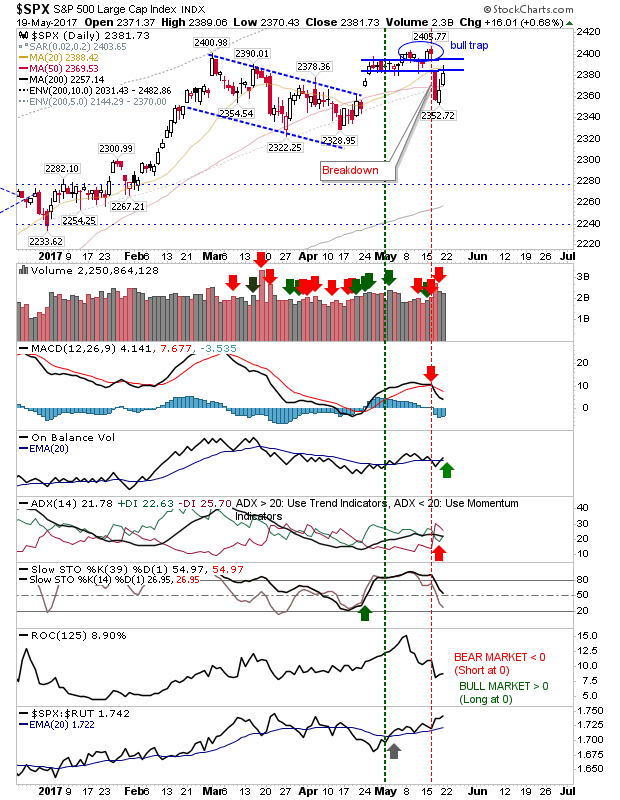

Relief Rally Approaches Resistance

Wednesday's gap created a significant reversal, stalling the mini-rallies kicked off in April. Thursday and Friday generated some come back against last week's loss, bringing many of the markets back to the highs of the gap down. The S&P is in a position where shorts may look to attack the gap. Friday's spike high put itself inside the gap, recovering the 50-day MA in the process. This gain was supported by a 'buy' trigger in On-Balance-Volume. While shorts might have the better risk:reward option, a move above 2,389 opens up for a retest of 2,405.