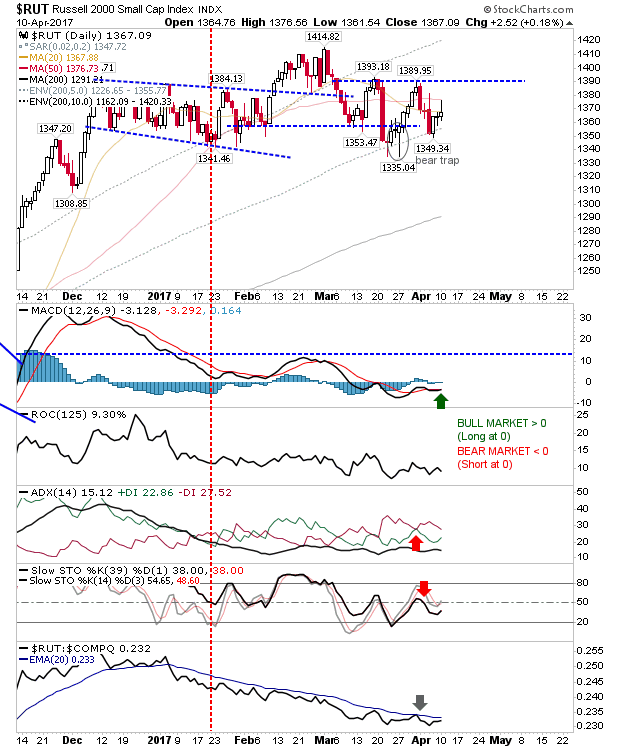

S&P Drops Below 50-day MA

The good work from yesterday was undone with today's selling. The S&P posted a clear break of the 50-day MA on modest volume and will next be heading to test support of the declining channel - which at the moment looks more like a 'bull flag'. Technicals for the index are net bearish, but are close to a recovery. It might look worrying, but the index could benefit in the long run.