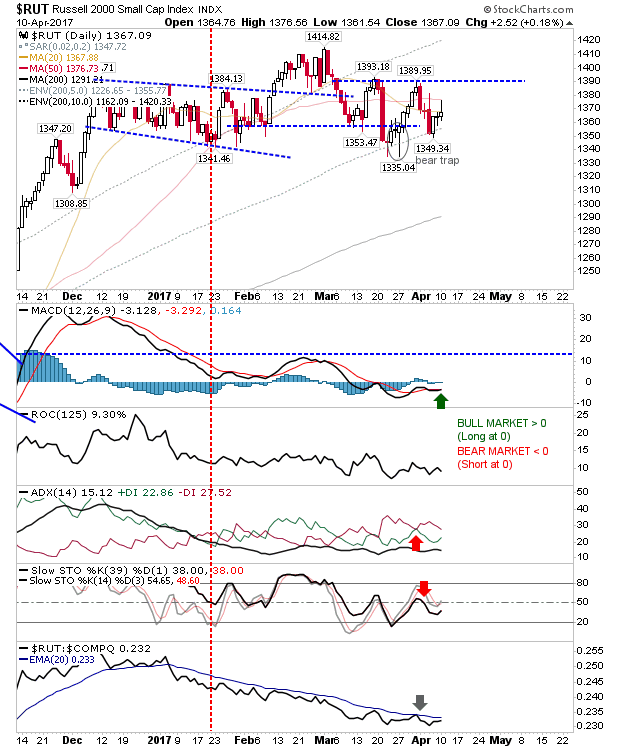

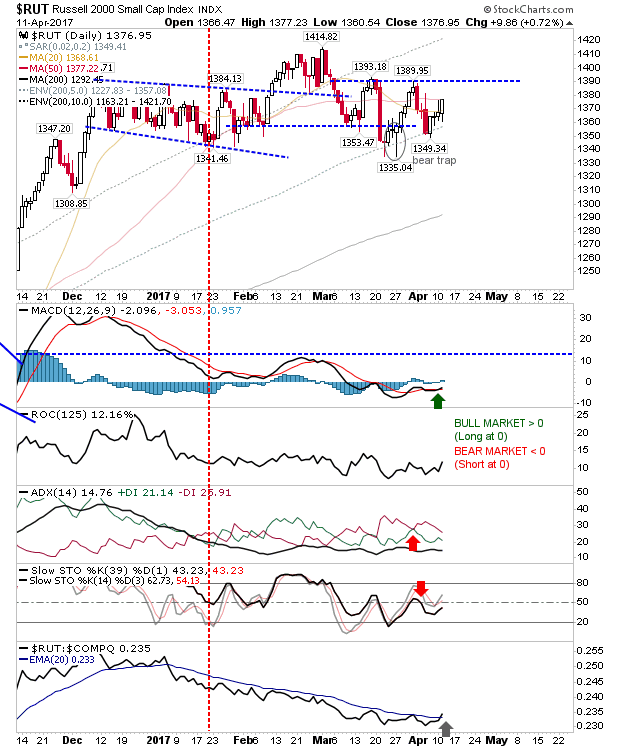

Russell 2000 at 50-day MA as Indices Mount Morning Recovery

It was a good day for indices as early weakness gave way to sustained buying into the close. There was early morning weakness to set the tone but it didn't last. The one index to rebuff this was the Russell 2000. After yesterday's respectable finish the index went on to rally back to its 50-day MA. The gains in the Russell 2000 were enough to trigger a 'buy' in the relative performance against the Nasdaq and MACD trigger 'buy'. Momentum buyers won't join the fun until 1,393 is breached, so another 20 points of gains could be on the cards before supply becomes a problem.