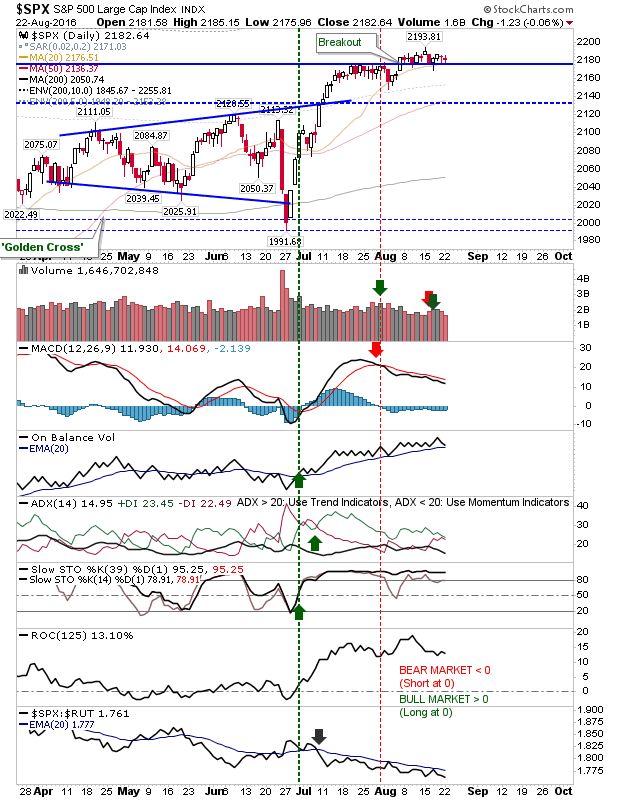

Meh Part II

The week started much like past week's finished with a whole lot of nothing. No volume, no action, no outlook. At least the S&P is holding breakout support. Watch for 'sell' triggers in +DI/-DI and On-Balance-Volume. The Nasdaq managed to gain a little, waiting for traders to break it out of its range.