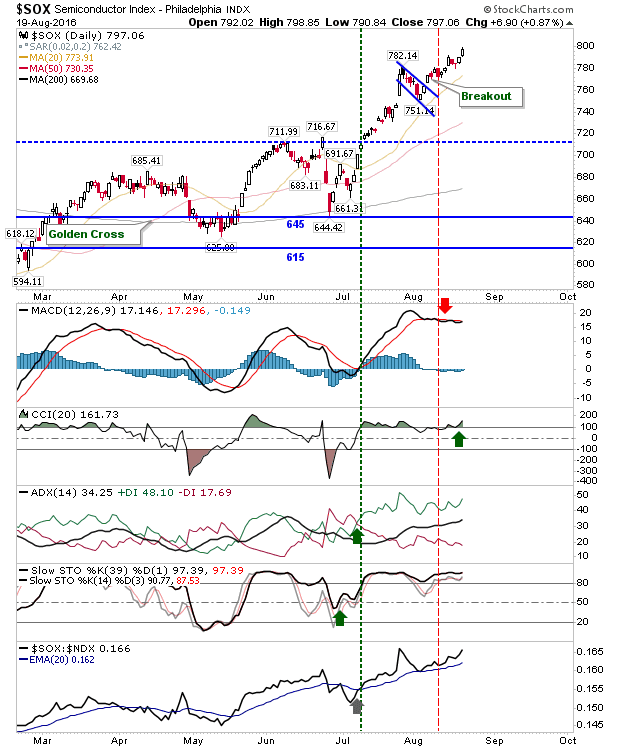

Semiconductors Continue To Advance

Markets continued with their sideways pattern in a refusal to succumb to easy profit taking. The exception looks to be the Semiconductor Index which continued to advance. The only disappointing aspect to the Semiconductor Index is the failure in the MACD to kick higher. It's not a deal breaker as price action and other technicals are very healthy.