Bears Break Deadlock

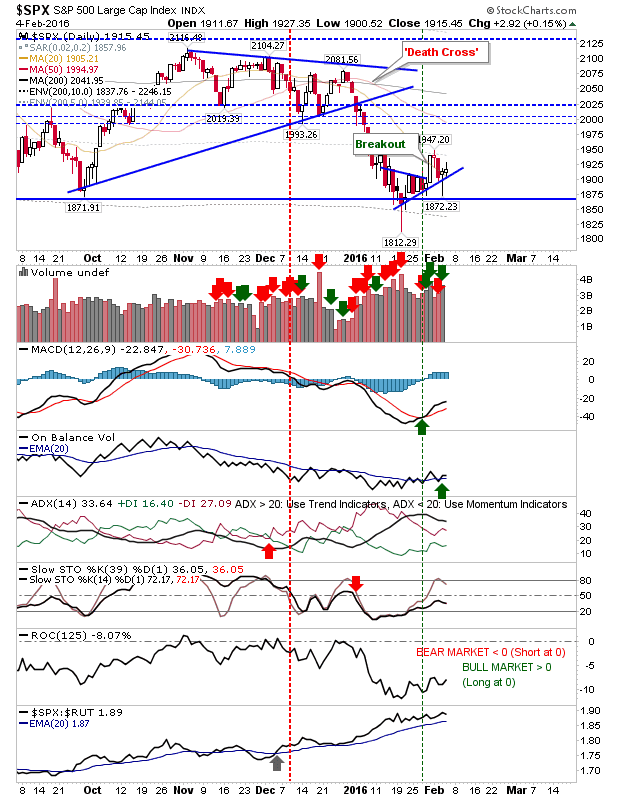

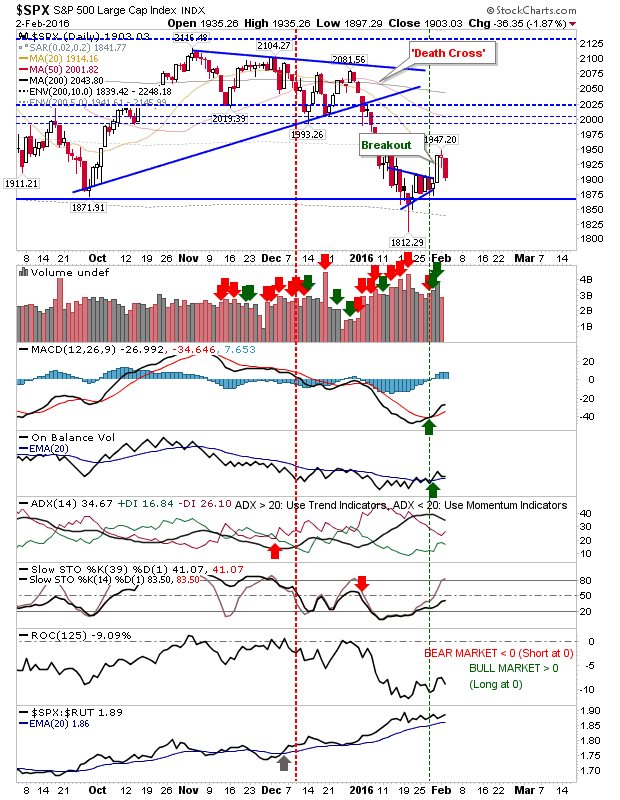

A quick post before the Superbowl begins. Friday's action was very disappointing if you were in the bullish camp; poor jobs data contributing to the malaise. However, investors can view this as another buying opportunity, with the Nasdaq clocking the 10% percentile of historic weak prices dating back to 1971, and the Russell 2000 making fast work of a push back to 958. Again, it's not about investing everything at once, but perhaps using the coming year(?) to build long term positions. I would be happier to see a 40-60% trim from highs - keep an eye on my bottom watch table, but this is the kind of action which helps reset the bulls count. The S&P registered a clear break of rising trend. Volume was lighter, so it wasn't necessarily a panic sell. And while it could be viewed as a breakown, the glass half full crew would see this as a drop back into the prior consolidation. The disappointing aspect is that the previous Friday's buying failed to follow through highe