Minor Gains

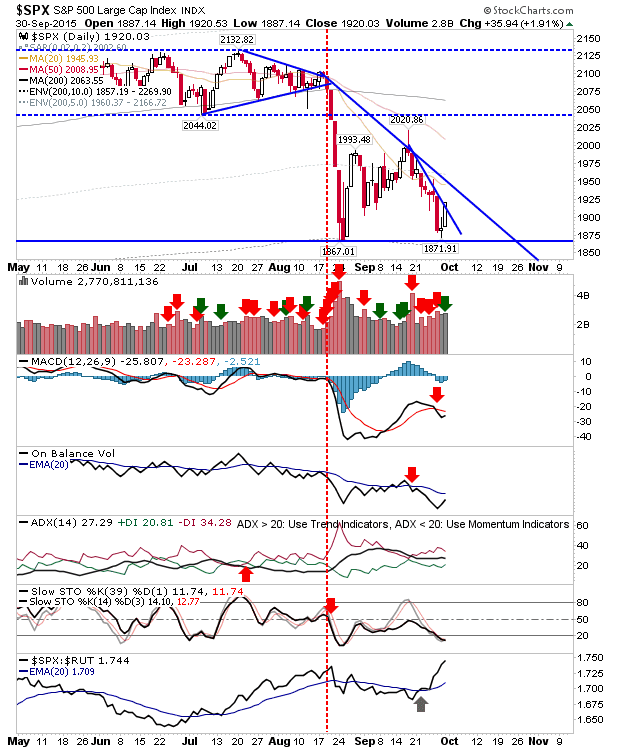

Things were looking a lot brighter in premarket, but in the end bulls were able to push markets into a higher close, even if volume was lighter than yesterday. The S&P nicks a breakout of declining resistance from the September high, but hasn't yet challenged declining resistance connecting August and September levels. Technicals hold on to their bearish outlook. Based on the table listed at the end of this article, the S&P would need to drop to 1,600 to register a 25% loss from highs.