Bulls Make Presence Felt

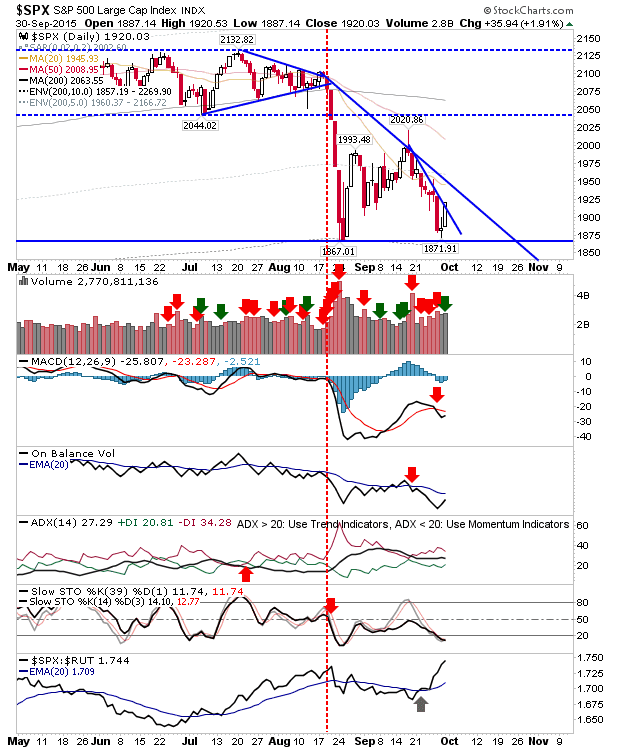

It was a better day for bulls as markets registered an accumulation day with respectable gains. However, only one index, the Dow, made a test of resistance (200-MA on hourly) and was initially rebuffed. The S&P registered nearly a 2% gain. The 20-day MA looks to be the next area of resistance as today marked a sharp break of declining resistance.