Scrappy Day

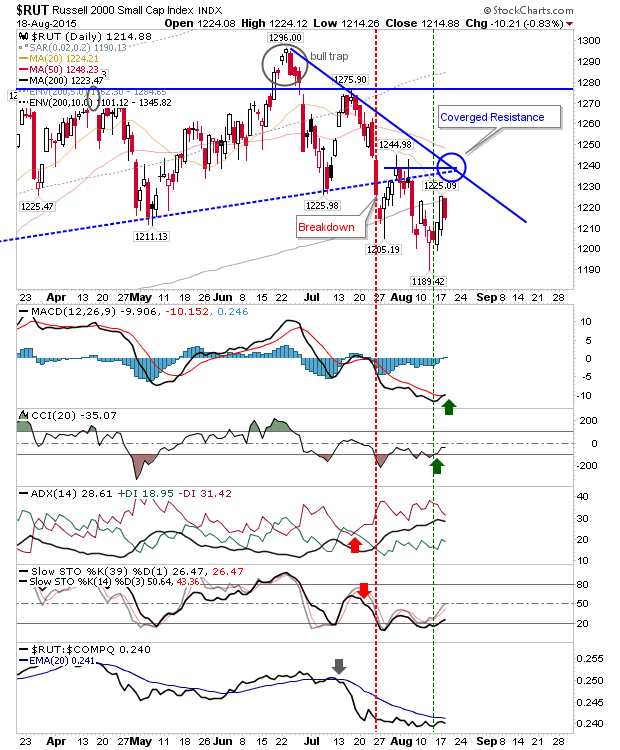

Tough day at the office with sellers having all of the fun until the Fed meeting minutes jacked up prices, only for sellers to return into the close. For the S&P, each test of the 200-day MA weakens it, and we are probably getting close to the point we get a decent push down, and a move outside of the longstanding trading range which has plagued this market throughout 2015. Even a modest 10% correction off highs would set it to drop below psychological 2000. Should such a move occur it should be welcomed like refreshing rain on a muggy day. The market needs direction. The Nasdaq dropped below 5,038, but 4,950 is key support - which is also close to where the 200-day MA is. Still plenty of places for buyers to step in, and this is not looking as vulnerable as the S&P. The key disappointment for Tech was the loss of support from what had looked to have been a bullish wedge in the Semiconductor Index. Technicals are again all net negative. The Russell 2000 had