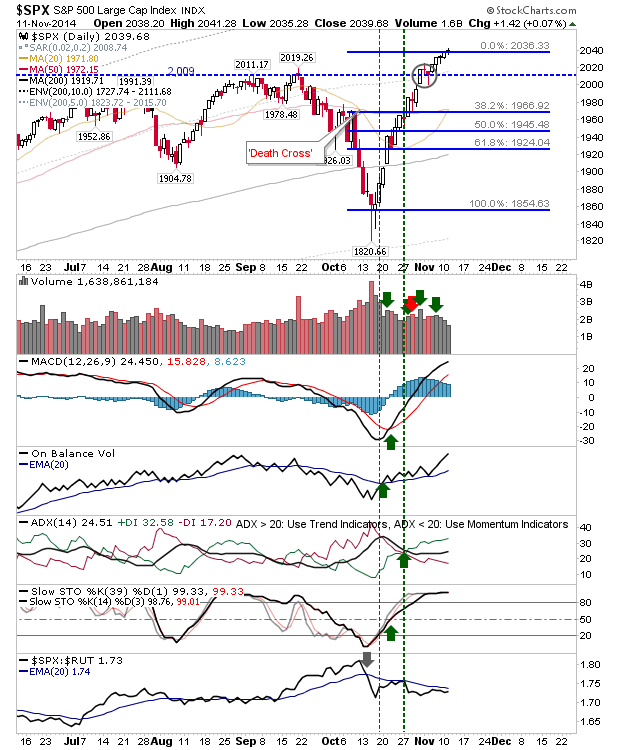

Late Recovery Comforts Bulls

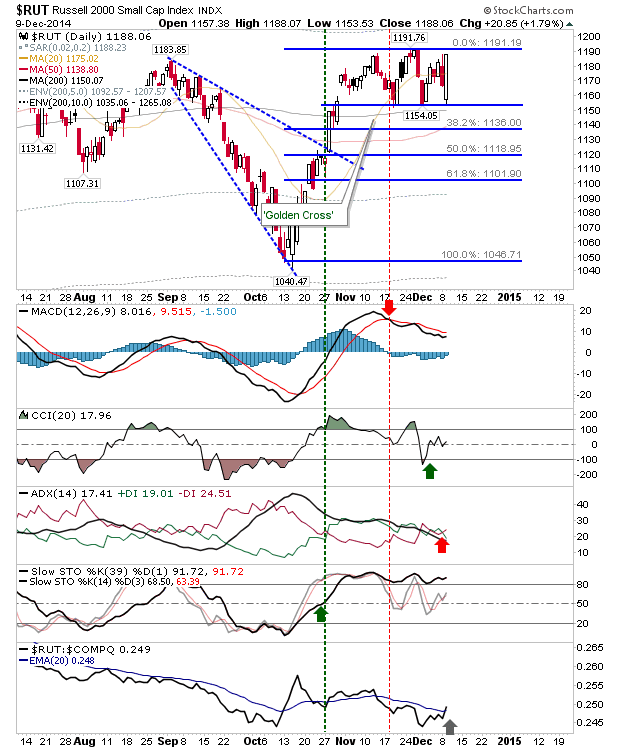

Not sure what to make of today. The recovery didn't look like one based on merit and will be vulnerable to early morning weakness. The Russell 2000 went from trading range support to resistance as it finished with a bullish engulfing pattern. The strength of the pattern is weakened by the lack of oversold conditions. However, price action will always be dominant. A poor start will increase the probability for a retest of today's low.